When quality over valuation can be murky

Quality over valuation has always been the tenet of successful investing. But what if there are 2 companies with comparable qualities and significant valuation?

Quality over valuation.

Buy great businesses at fair price instead of fair businesses at great prices.

The tenet of proper investing has always been clear and straightforward.

It was also drilled strongly into me after I bought a local Malaysian steel mill 9 years ago, and closed the position just last month at a loss.

Ever since then, I believe I am on the right path, with successful acquisitions in the likes of NVDA 0.00%↑, AMD 0.00%↑ , MSFT 0.00%↑ , GOOGL 0.00%↑ and META 0.00%↑ to name a few.

As I seek to diversify my portfolio from being tech heavy, this has led me to dive deep into evergreen businesses that I am quite certain will be around at least until I leave this world.

The picks and shovels approach

As I embark on a thought process to discovering great companies to invest outside of tech, the approach led me to look at the picks and shovels of businesses from a variety of industries.

That led me to deep diving into Linde Plc LIN 0.00%↑ and published my first stock analysis on Substack.

Shortly after that is done and dusted, my head is now turned towards the picks and shovels. Literally.

The heavy machinery industry

The heavy machinery industry, in my opinion, even though cyclical, do have investing gems.

Firstly, there are already a handful of companies within this industry that has outperformed the S&P 500. There are also companies within this industry that Dividend Aristocrats.

And to top the cherry on the cake, they have been around for more than 100 years. They will not be disrupted by AI (unless if you refer to mining intangible coins on the internet).

A tale of two juggernauts

Perhaps the pharmaceutical industry is too fragmented and needs more time. I stumbled upon Caterpillar Inc CAT 0.00%↑ from one of the Seeking Alpha notifications on Deere & Co DE 0.00%↑.

And as I dug deeper, I am pretty sure both Deere and Caterpillar are the creme of the crop within this industry, in terms of quality and track record.

The headache arises when I was determined to pick a winner out of the two.

Why Cat vs Deere?

The heavy equipment vehicle segment can be competitive. There are easily a handful of companies that operate in this segment.

Caterpillar holds the largest market share, albeit at just 16% based on the latest data in 2022 which I can obtain. Other notable players include Komatsu Ltd (TYO: 6301), Sany Heavy Industry Co Ltd (SHA: 600031) and Zoomlion Heavy Industry Sci & Tch Co Ltd (SHE: 000157).

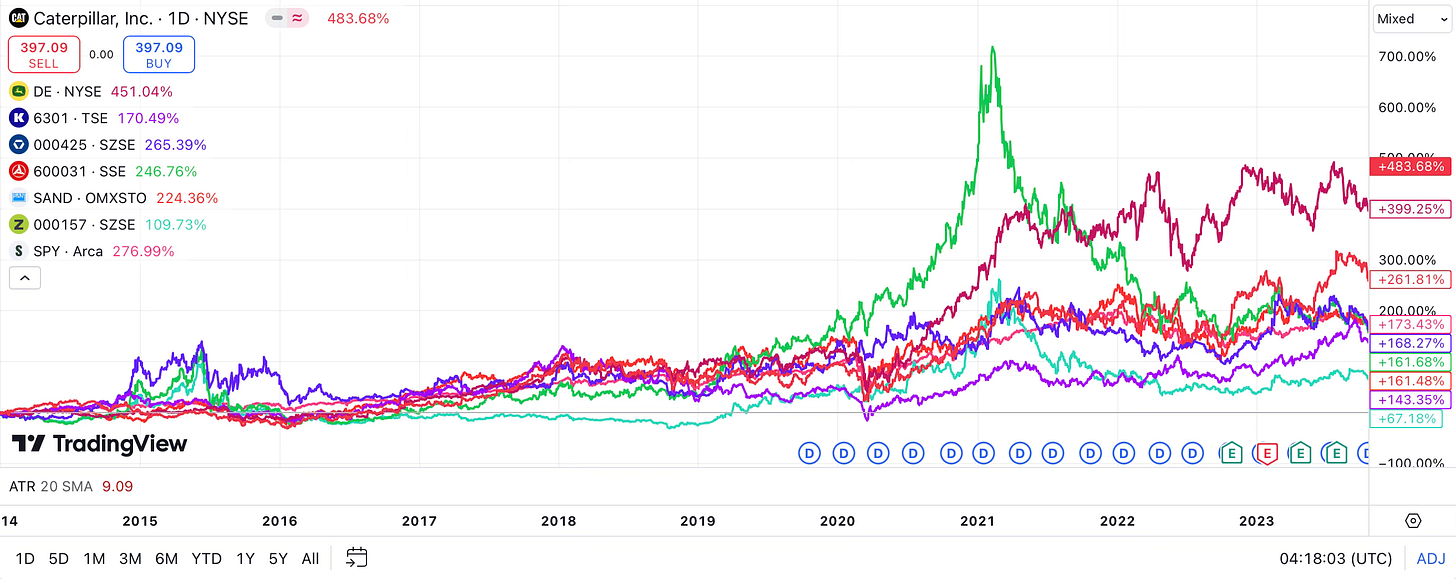

Judging from a 10-year total shareholder return with dividends included, only 2 companies out of the sector seem to be outperforming the S&P 500 SPY 0.00%↑.

Investing my own capital, my mandate is to outperform the SPY on a long term basis. Returns for Deere and Caterpillar seem to fit the bill very much.

The headache arises

I acknowledge both companies look promising. But if I were to pick one out of the two to spend more time on, this is where the headache arises.

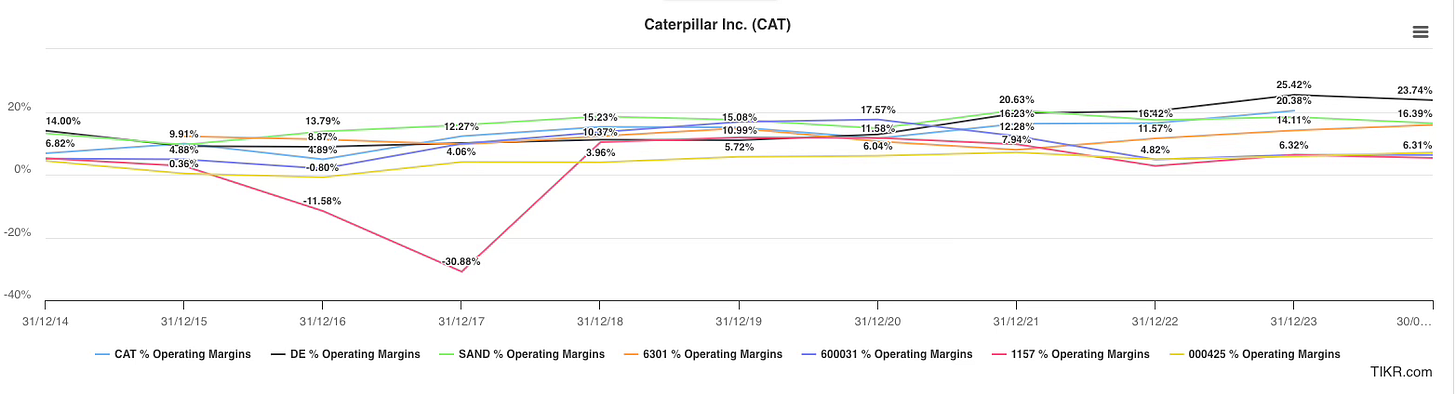

When I take a look at operating margins, its clear that Cat and Deere are way ahead of its peer, easily coming in with more than 20%.

The same observation goes for return on assets.

Deere used to report a better FCF margin than Cat, but has recently seen Cat outperforming it.

So from a basic screening and comparison, Cat looks to be relatively a better company than Deere. Thus, it would justify it a premium valuation.

How much more premium to Cat or discount to Deere is justifiable?

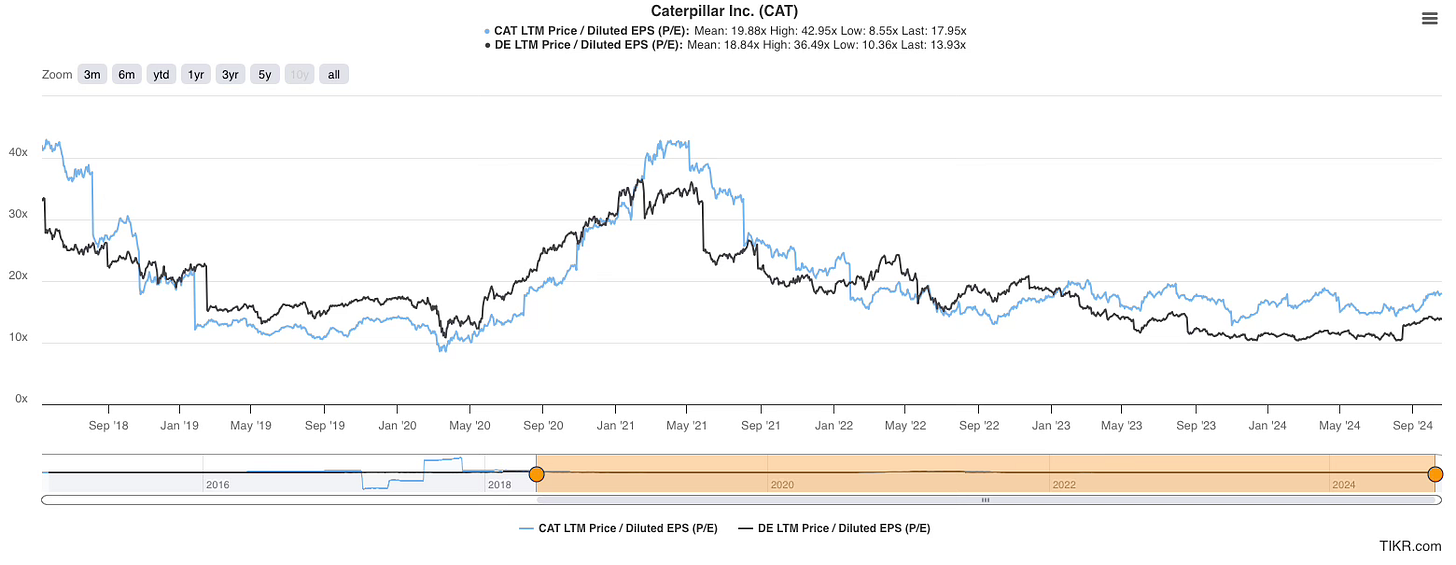

The valuation portion stumps me a bit. How much of a valuation premium to assign to Cat, or how cheap it is to convince to scoop up Deere. The quality and valuation conundrum surfaces.

Deere is still a company with, albeit just a bit less if compared to Cat.

Deere looks cheap at a price-to-earnings of 14x, while Cat is also trading at just below its long 6-year average of 20x.

So should an investor fork out the cash to the better company - Cat, or justify that Deere looks cheap with quality on its belt as well?

Buy both?

As I was still contemplating choosing the best between both in terms of balancing the quality and valuation barbell, I was reminded by how similar the situation is as with NVDA 0.00%↑ and AMD 0.00%↑.

Both NVDA and AMD are in the same business, but both have slightly different key focus area. AMD has always traded at a discount versus NVDA, but that doesn’t mean it isn’t a good business.

Cat will provide quality equipment and machineries to the construction and mining industry. I don’t foresee a future where construction and mining becoming obsolete.

The same theory applies to Deere as well. If agri-commodities will continue to be the building blocks of feeding the global population, Deere’s business is as evergreen as ever.

Perhaps rather than bicker and get myself into a spiralling headache of choosing one among the both, maybe just consider having both in my buy and hold portfolio?

From your valuation, it seems that you are not a swing trader. However currently construction machinery purchases are declining. So maybe the CAT is not ideal to buy in a short run, because its stock price is pretty high. Here is the correlation between CAT income vs total sales in construction machinery equipment: https://drive.google.com/file/d/1bSeTVHOwT-rF4ikk8Ofq4QqlhHvDbqsD/view?usp=sharing