Losing Trade Series 1: Closing off my rookie mistake long position after holding it for close to 10 years.

There was a time where I was naive - thinking that the largest steel mill in Malaysia has prospects in a protectionism industry

Foreword

10 years ago, Malaysia counts itself in a an infrastructure expansion phase. Construction and property was in a booming phase. Talks of the next tallest building in the country, a new township equipped with a high speed rail (HSR) that promises connectivity to southbound cities in Malaysia, eventually ending at Singapore.

And it really isn’t hard to fathom who would be the beneficiaries. The local construction and steel makers were assumed to be riding on tailwinds of this prospect.

Picking an alleged gem from a pile of iron ores

There were only a handful of them listed. I found Ann Joo Resources Berhad (KLSE: ANNJOO) being the one with the largest market share domestically. It is the first modern blast furnace (BF) in Malaysia and also the first and only in Southeast Asia combining the technology of BF and Electric Ark Furnace (EAF).

Annjoo had the best profitability against its peers, has the best free cash flow.

Even though the steel players in Malaysia were not price effective when compared globally, the anti-dumping laws in Malaysia do shade the local steel companies from cheaper sources.

A catalyst that did not materialise

An unprecedented change in the ruling party government saw mega project plannings coming to a halt. Even though Anjou’s share price has started to dip before the change of guard, it eventually sent share prices down to multi-year low with mega projects put on hold.

I admitted the mistake, but since the company wasn’t in any distress, I wanted to wait for the next rally to close my position at a lesser loss or even a small gain.

Waiting for a rebound that never came

To start things off, Annjoo was still a functioning business.

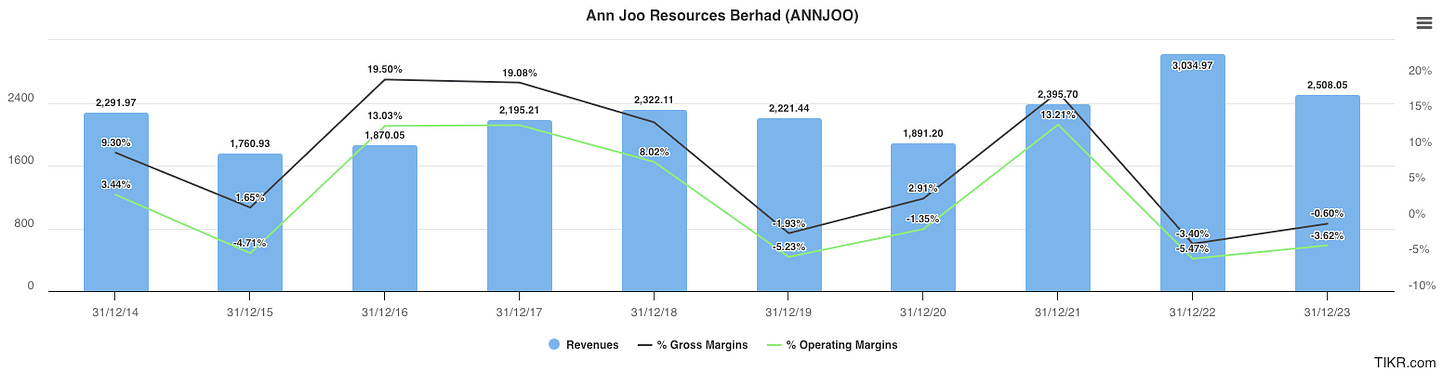

Revenue was flat over the last 10 years. No significant slump or deterioration of its top line. So I wanted to wait for the next run to close my position.

But looking at the gross and operating margins, it is inherent that the cyclicality nature of the business is punishing Annjoo.

A negative gross margin and operating margin, just means that the business is forced to operate at a loss. Or for more sophisticated investors, there really isn’t any/effective hedging mechanism that the company employs to keep itself shielded.

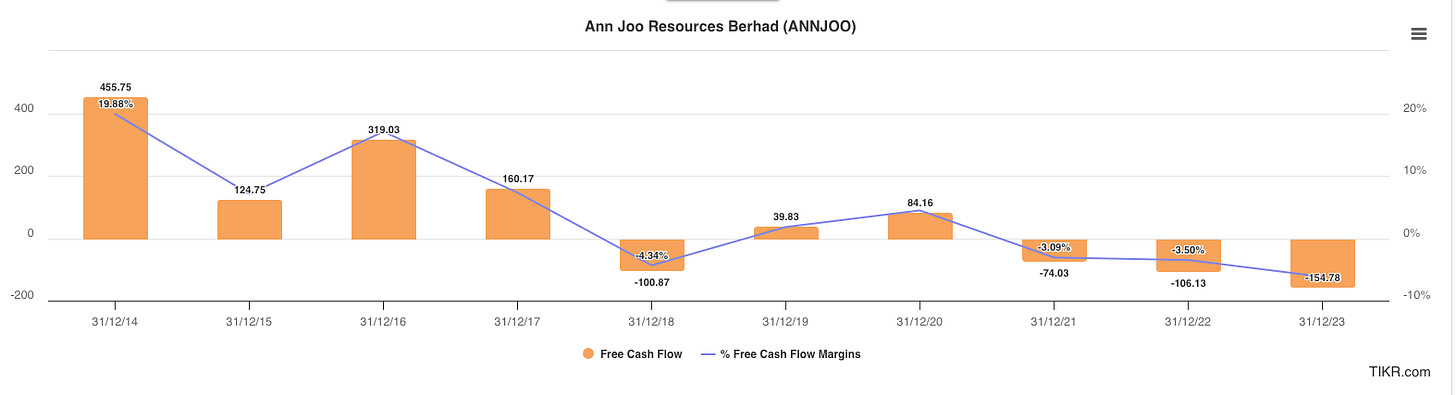

Free cash flow and free cash flow margin is trending down, and eventually dipped into the red in FY 2021, and exacerbated in FY 2022 and 2023 where other industries have already reported a recovery from the pandemic.

The last straw

I have done plenty of rookie mistakes years back. I was fortunate to be able to close my positions when the time comes at minimum losses and sometimes even with a gain.

Annjoo was the last position for me to close, initiated during the early days of my ignorant investing days.

But this loss materialisation was in the making. The company was not raking in cash from its business. The longer I held seemed to potentially expose me to more potential downside.

When news of a potential cash call surface, I knew that I cannot wait for the next upswing to dispose my shares on hand.

For such a business that is at the mercy of global prices, with no inherent hedging mechanism to protect shareholders’ equity, a cash call with more shares outstanding would just make it harder for accretive earnings to materialise, supporting any bullish stance for share price to go up.

After fumbling and logging onto a trading platform that I have not used for many years to key in my sell order, I managed to close my position on Annjoo on the 10th of September, 2024.

Total loss booked = MYR 12.3k (USD 2.9k)

Lessons and thoughts

Closing the position post the slight fall upon news of the rights issue surfacing meant that I booked more losses. But it wasn’t that much compared to the peak to trough selloff.

The mistake and lesson I committed for Annjoo went on to become a lesson cornerstone to how I invest now - if it isn’t a good business that can grow and dictate prices, don’t even think about buying it.

Back then, my investing universe was solely within the borders of the Bursa market. A decent steel making company became a holding of mine just because of the perceived catalyst it holds, only for me to realise down the road, decent companies will not compound wealth efficiently over a long timeframe.

A loss of MYR 12.3k or USD 2.9k was also an amount I was too afraid to realise back then as a young man. Today, even though its not a small amount, but I am more than comfortable of realising this loss on the book.

The realised loss will be a stern lesson that seeking the best business to invest for wealth compounding must not be geographically restrictive. Because if our horizons are restricted, so will be our potential investment gains.