*For the business model of Linde plc, please head over here for Part 1

*For the financial and competitor analysis of Linde plc, please head over here for Part 2

LIN 0.00%↑ Linde’s share price is up 10% since the start of the series.

For a company with such considerable economic moat, it definitely does not come cheap.

I will approach Linde’s valuation using a few models, and then proceed to my strategy.

Price to earnings ratio

There are plenty of sources to get the P/E ratios.

Below is the 10-year historical P/E band of Linde.

Linde trades near its mean P/E of 34x. Its median P/E is almost 40x.

The P/E ratio is high compared to companies from other industries and sector. But there is a price to be paid on the relative resilience.

I am tempted to wait for something below P/E 30x, which translates to a share price of USD 393 per share. So roughly around USD 400 a share. That would mean a -20% from current share price, something that would be achievable when there is a significant correction.

The last 2 times where Linde traded below P/E 30x, was during the pandemic period and prior to Jul' 2017.

Total enterprise value / EBIT

Linde also trades at a slight premium when looking at its total enterprise value against its EBIT, at 28x.

Its mean is at 27.5x, with a low at 14.7x.

If I target a an entry price of 24x, it would be at a price level of USD 382 a share.

Discounted cash flow

This was initially hard to grasp. But after adjusting the assumptions, I think I manage to come out with a reasonable DCF for Linde.

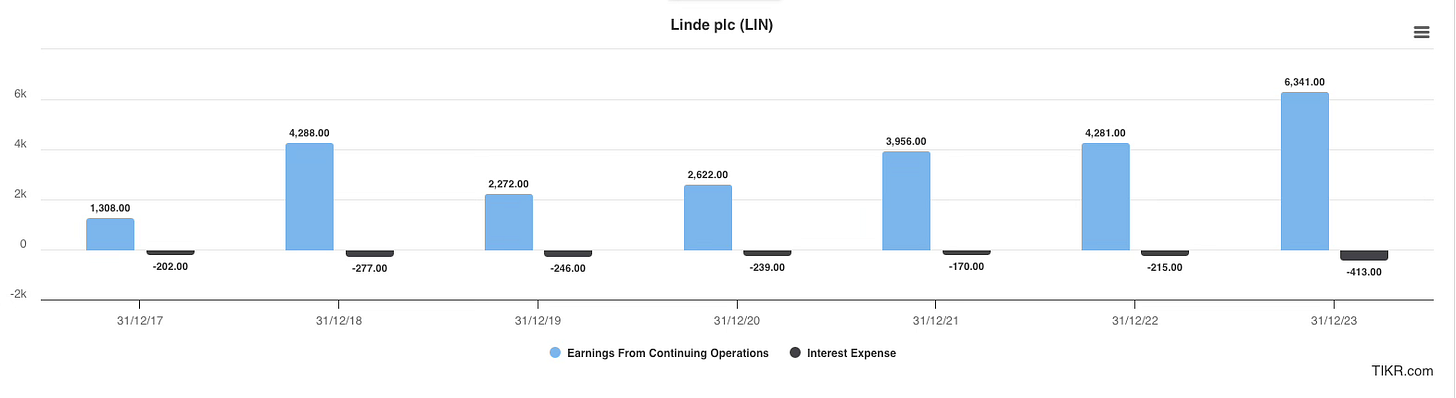

To begin with, below is the EBT and interest expense. I added back the interest to derive the EBIT to simulate the unlevered free cash flow for a growth rate of 15%, 17%, 19% and 21%.

I used a 9% discount rate and a long term growth rate of 4%. 9% is used as Linde tends to be on the stabler side.

Below is the metrics for DCF for annual growth rates of 15%, 17%, 19% and 21%.

With Linde’s market price closing at USD 479.51 per share, the back calculation is assuming Linde is growing its EBIT by just shy of 16.5%.

That said, if we assume that Linde will grow its EBIT by just 15%, fair value would be at USD 392 per share, also around the USD 400 price target.

Recap

Price to earnings ratio of 24x = Target purchase price of USD 393

Total enterprise value / EBIT 24x = Target purchase price of USD 382

Discounted cash flow based on EBIT 15% growth rate = Target purchase price of USD 392

Strategy

I would be looking to initiate a long position on Linde Plc if prices touch USD 400 per share. For this opportunity to present itself, it would most likely be during a big market correction.

It would most likely be a lump sum deployment as Linde has a track record of trading at a steep valuation due to its stability and predictability.