Linde plc: Part 2 - The financials & competitor comparison

How an evergreen business financials look like

*For the business model of Linde plc, please head over here for Part 1

LIN 0.00%↑ financials might not look as great if you have been looking at tech all this while. However, I credit the company, which operates in an evergreen industrial space for its performance over the years.

Topline and operating metrics

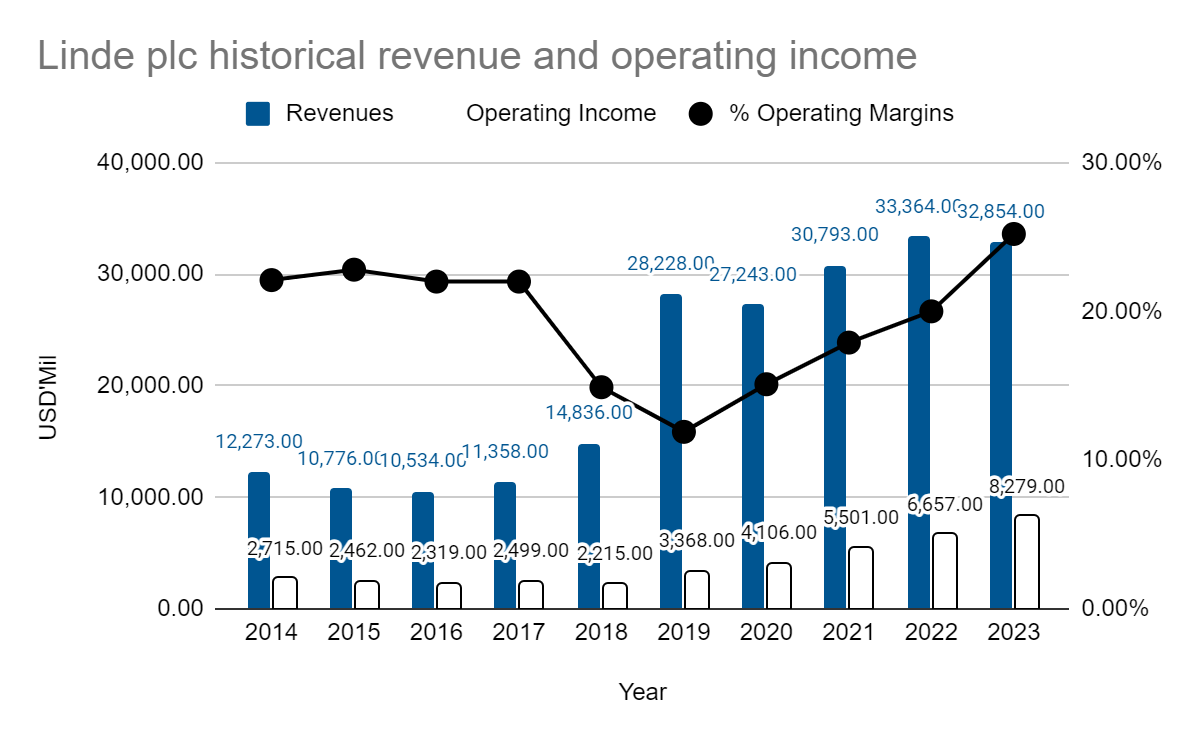

Let’s talk about Linde’s toplines and operating profit from a 10-year horizon

Before FY 2019, revenue showed stability. Even though there were contractions in terms of growth, operating margins were consistent at 22%.

In FY 2019, Praxair and Linde merged, significantly boosting the revenue to USD 28 billion. Higher selling, general and admin expenses whittled the operating margin down to 15%. And it would be acceptable for the company to spend the initial few years post-merger to optimize its operations.

I might have gone overboard by calling the business evergreen - note that revenue dipped slightly in FY 2020 during the pandemic-stricken year. But Linde does have a knack for growing its profits more than its topline.

Total selling, general and admin expenses remained flat and even contracted post-merger. This indicates that Linde has swiftly and successfully made the merger accretive. Depreciation & amortization are the only increased cost, signalling the company is still voracious in growing and undergoing capital expenditures.

With the topline growth and operating expenses stable, operating margins took off post-FY 2019, expanding to 25% in FY 2023.

That’s spectacular for an industrial and capital-intensive business!

Zooming into FY 2023, particularly in review,

Sales of USD 32.85 billion, 2% below 2022 sales. Cost pass-through, which is the contractual billing of energy cost variances, primarily to onsite customers, decreased sales by 3%. Engineering decreased sales by 2%. Volumes decreased sales by 1%, and currency translation by -1%.

Reported operating profit of USD 8.0 billion, 49% above 2022. This was primarily driven by the Russia-Ukraine conflict and other charges, including higher pricing, savings from productivity initiatives, lower D&A.

Source: 2023 Annual Report pg 21

The merger has been accretive regarding the bottom line and earnings per share, driving EPS higher.

Cash flow analysis

I think the cash flow generation and free cash flow margins stand out the most.

Post-merger, cash generated from operations grew by around 20% CAGR, while free cash flow grew by close to 25% CAGR.

Due to the nature of Linde’s business, energy is one of the largest cost items. Managing contracts and process efficiency is crucial to mitigate fluctuating and uncertain energy costs. Large customer contracts typically have escalation and pass-through clauses to recover energy and feedstock costs.

Linde’s business might be infrastructure intensive. However, it can generate significant operating and free cash flow when done right.

Balance sheet

There isn’t much to nitpick on Linde’s balance sheet.

The only jarring observations I found were the huge drop in retained earnings and the sudden contraction of treasury stock in FY 2023.

In FY2023, Linde plc’s stock on the Frankfurt Stock Exchange was effectively delisted. Linde plc used to be fully listed on the Frankfurt Stock Exchange, but during the early years post-merger with Praxair, the stock maintained a dual listing on both NASDAQ and Frankfurt.

Effectively on the 2nd of Mar 2023, the company’s share will be solely listed on NASDAQ. The retained earnings are reduced in the form of capital reduction, while treasury stock held by the company is also “cancelled off”.

So why Linde and not its competitors?

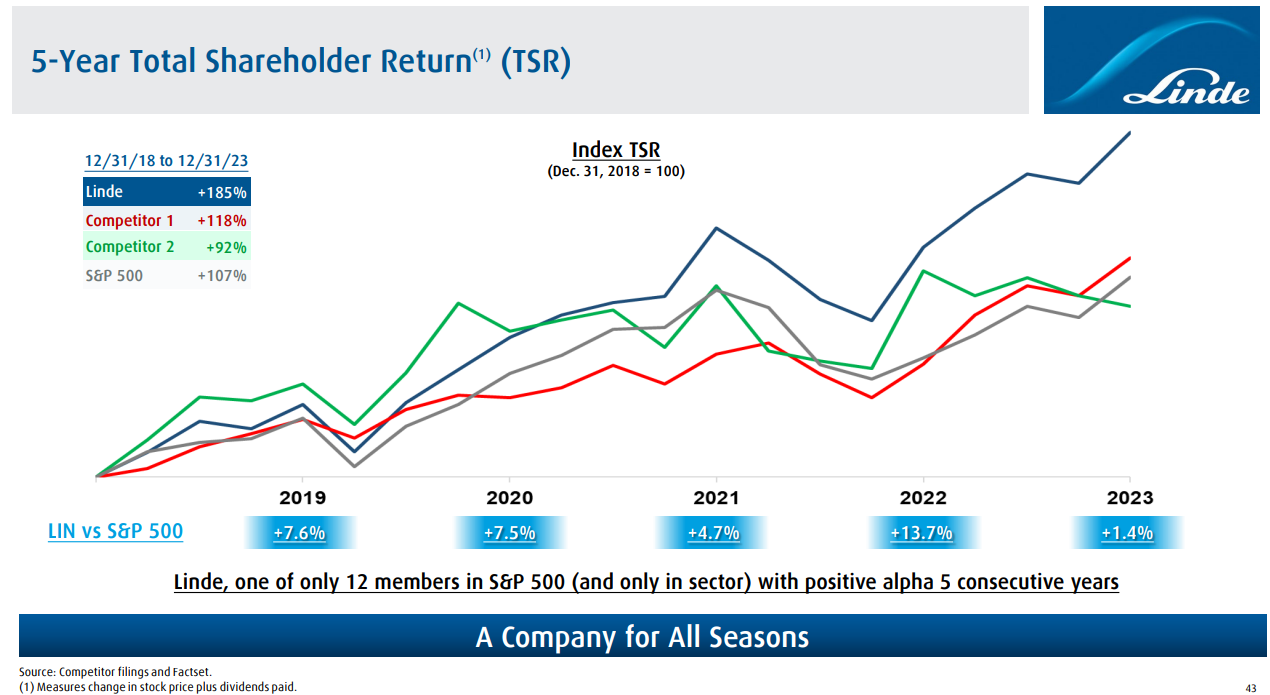

Linde went as far as to compare its historical performances with some of its competitors.

The colours used for competitors 1 and 2 are uncanny and it hints at Air Liquide and Air Products.

Linde has a much superior operating profit margin. EPS-wise, it has also grown more compared to Air Liquide and Air Products.

Absolute term-wise, do take note that FY 2019 is when we saw the merged results of both Praxair and Linde.

YoY growth-wise, it is reassuring to see Linde continuing to grow EBIT more than Air Liquide and Air Products. It might be the bigger of the 3, but in the world of industrial gas manufacturing, size, efficiency and operating supremacy come hand in hand.

Linde’s topline might not be growing in double digits, but having the track record in improving its margin, and beating the S&P500, warrants a deeper look and consideration as a stable component outside of tech realms, which are susceptible to meltdowns and selloffs.

Curiosity got the better of me, and I wanted to know whether Linde has always outperformed the S&P 500.

It seems like the inflection point happened somewhere in FY 2019. The outperformance began to widen more since then.

Is it too late to buy Linde now?

I have got to admit, that valuations look a bit premium for Linde now. Am I attracted to the idea of owning this company? Absolutely!

Can the company continue to deliver double-digit returns to shareholders year in and year out? The management seems to be walking the talk.

I for one, am waiting patiently on the sidelines for a selloff to occur before doing a one-off lump sum on this company.

Great discounts on such companies are rare, which is why I would do a lump sum instead of an average down tranche by tranche method.

As for what valuations are fair, please head to pt 3 - Linde’s valuation & my strategy