Inditex S.A.: Part 2 - The financials

Can a fast fashion business be profitable, generates cash and has spectacular balance sheet?

*For the business model of Inditex, please head over here for Part 1.

The business model of a fast fashion retailer might not be sexy, but Inditex’s one has managed to caught my attention.

And as I delved deeper into its financials, I become more excited.

Topline and operating metrics

A 10-year revenue growth momentum is a key indicator that all is well in terms of growth. Although it does not mean Inditex is immune to future challenges, at least the company is not showing weaknesses in the face of SHEIN and other fast fashion.

The stable gross margins around 55% is this challenging business means that there is no sacrifices in margin even though the fast fashion industry can be a red ocean strategy, at least from how Inditex is run.

On top of growing revenue and gross margins, the fixed expenses are well controlled - evident by the improving margins and growing operating income and net income.

Balance sheet and operating ratios

Let’s get the highlights of the balance sheet. You ready?

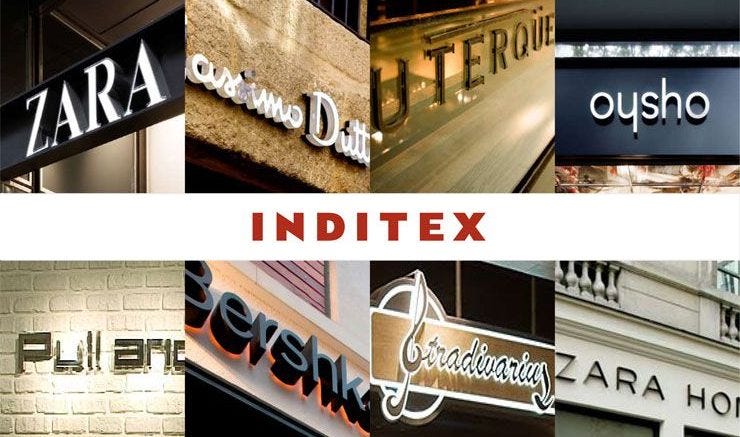

Net cash. Yes. This fast fashion company is net cash.

So you might expect return on assets and equity to be slightly lower due to almost no leverage in Inditex’s balance sheet. Well take a look.

Inditex’s ROA runs at an average range of 14%. ROE hit just above 30% over the past 2 FY.

These ROA and ROE are atypical for a company that does not utilise much debt or leverage.

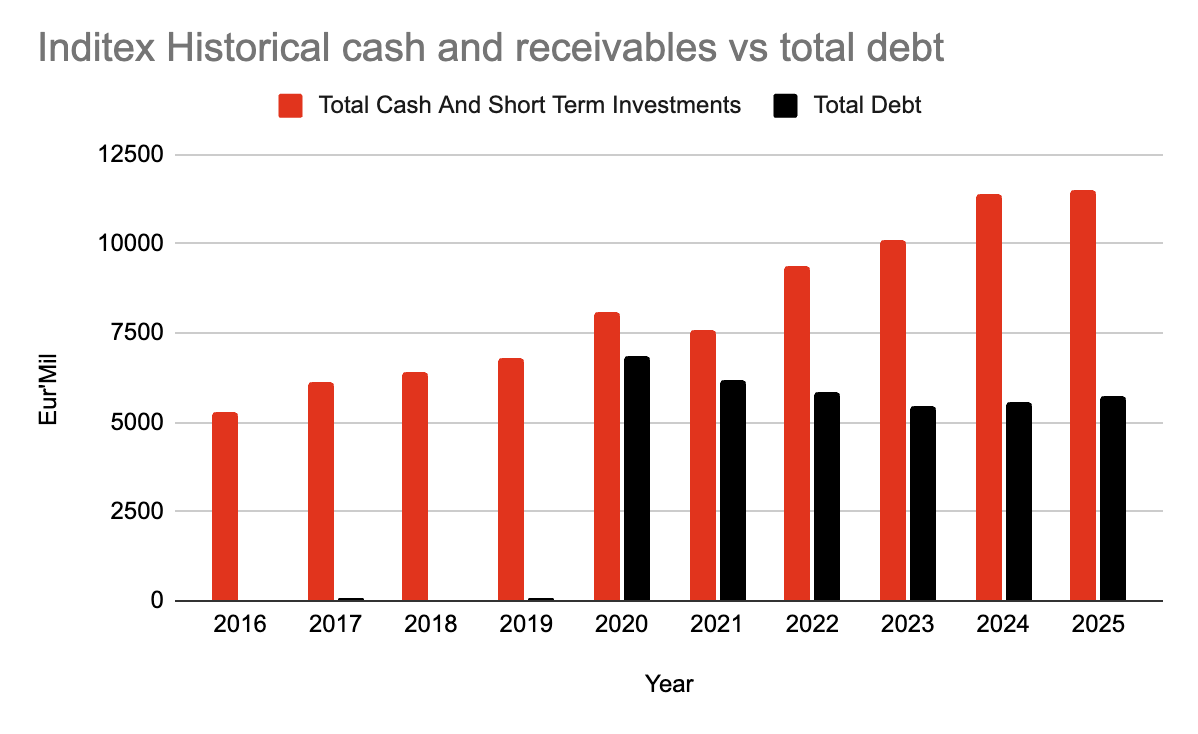

And with quick and current ratios above 1.0x, there really is no concerns on Inditex managing its liabilities.

Cashflow activities

Inditex’s operations cashflow has been on a stable growth since FY 2020. Omitting the one-off break in FY 2021 due to COVID-19, Inditex is pulling in more cash from its operations.

It is worthwhile to also mention that after Marta Ortega’s succession in FY 2022, Inditex growth spurt accelerated.

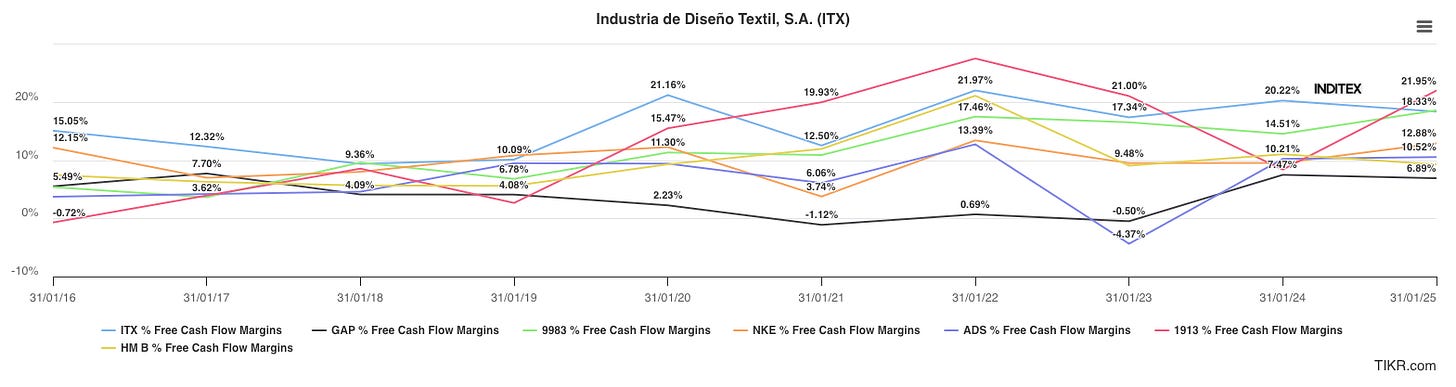

Drilling down to free cash flow and free cash flow margins, observed 10-year trend not only showed Inditex is growing its free cash flow, but FCF margins have also expanded from below 15% to breaching above 20%, stabilising just below the 20% mark.

Why Inditex?

To compliment the peer comparisons in my earlier post, I wanted to see the free cash flow margins across a myriad of fashion players.

Inditex’s FCF margin has a track record of being one of the highest in the fashion industry. It only misses out to pure luxury fashion players like Prada Spa (HKG: 1913), which of course commands a higher profit margin due to the prestige of the brand itself.

Inditex would be skewed towards the mandatory rather than discretionary in Europe due to their affordability. However over in Asia, the mass market do have cheaper clothing alternative brands, albeit sacrificing on the quality end.

I would count on Inditex to be more resilient during economic downturns versus the luxury boutiques, and even if sales are badly deteriorated, the robust balance sheet gives assurance that the company will not be plagued by debt obligations.

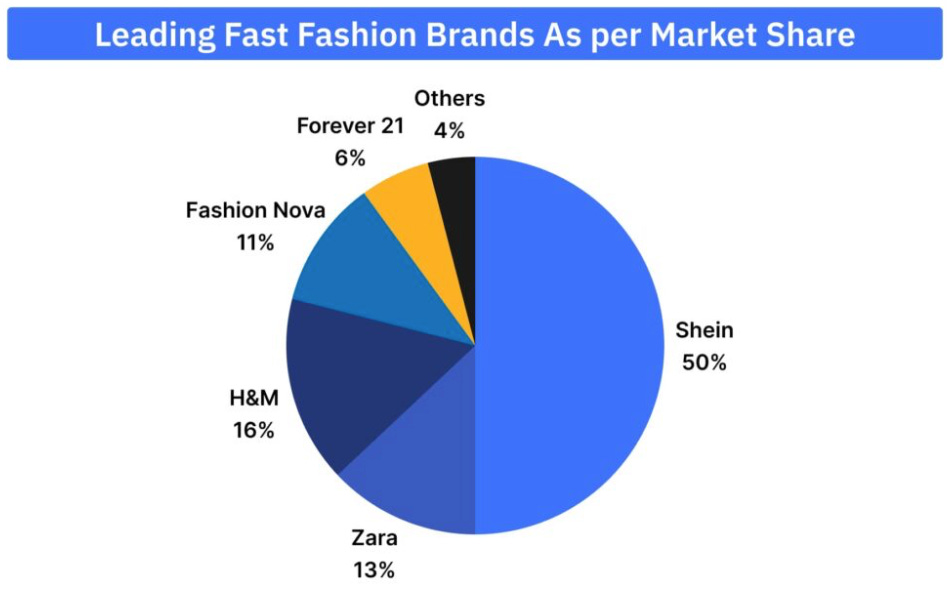

Yes, the big picture shows SHEIN gaining market share. But with the company earning the same amount of revenue, yet still bleeding cash, it raises my eyebrows on when will SHEIN ever be able to operate normally as a stable company.

The fast fashion company is not an “either or” company. Shoppers with spending power can buy apparels from whichever boutique which offers the best bang for their buck and also quality and trendiness.

So rapidly eating up market share in the expense of burning cash rapidly, might not be a rational rapid scaling strategy at least for the fashion business.

It’s never a wrong business that derives its earnings from women

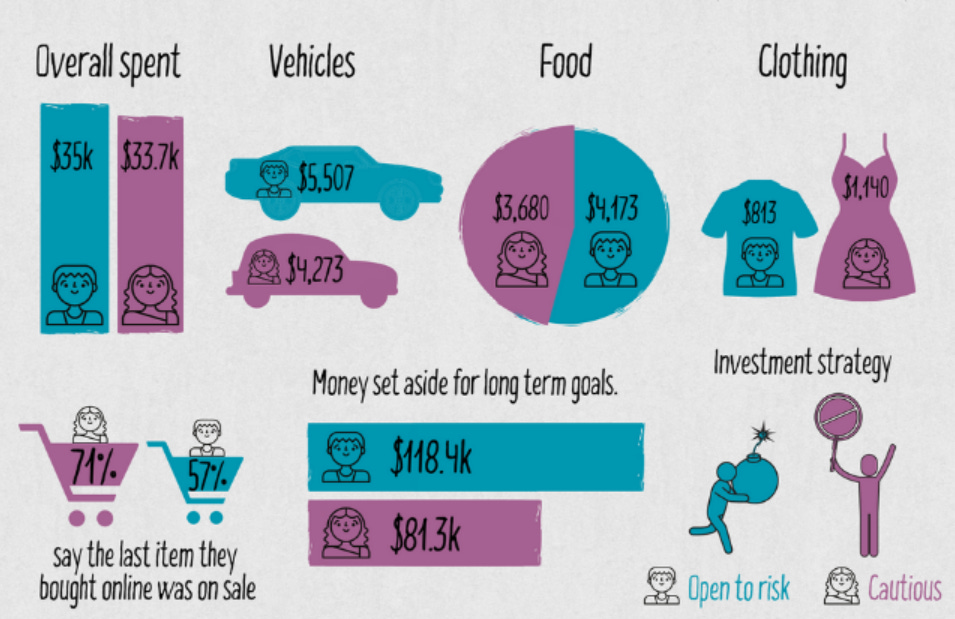

In Mandarin there is a saying that a “earning a woman’s money is a great business”. Not to be sexist in anyway, but this is well supported by facts and figures.

You might come across other data sources which states men spend more, but just to step back and think holistically, women dress choices are always more varied compared to men, although men apparels might cost more than women’s.

So the effort a woman goes through to ensure her wardrobe is well equipped, in terms of style and colour is overall going to cost more.

That is also the main reasons why fast fashion target the female consumer more with offerings versus men.

Not the best business model, but definitely the best company in the sector.

Fast fashion will forever be marred by ESG, which is slowly becoming more important.

But a quick check on Know The Chain by Business & Human Rights Resource Centre, Inditex’s scoring is commendable - 15th on the spot, beating notable names like Moncler, Tapestry and even Hermès.

However, this shouldn’t be the final form of a company that I think have more to achieve and much more to be done to survive and persist for the next 20-30 years at least.

But based on what I can observe, it looks to be heading at the right direction.

So if that is the case, what would be the fair value of Inditex?

Pt 3 Inditex’s valuation & my strategy will divulge the answer.