Inditex S.A. : Part 1 - The business

The fast fashion business is ever evolving. So why am I spending time on a company that can be easily crushed if competition is faster?

The next company featured on ARIC might not be a familiar name in the investing world.

First off, it is not traded on the US market. It is traded on the Bolsa de Madrid - the Madrid stock exchange in Spain. Secondly, it operates in the fast fashion industry, an industry where speed to market triumphs, often skirting with design legislation lawsuits and labour concerns.

With plenty of fashion companies falling out of trend due to the evolving scenes of the fashion industry, the basic rule of thumb of even contemplating an investment thesis is that investable candidates must have certain brand appeal and equity.

So why Industria de Diseño Textil, S.A. (BME: ITX), or more commonly known as Inditex?

History of fast fashion and the current scene

Fast fashion is a business model that has raised eyebrows and scrutiny in the world of apparel. Unlike the fast food counterparts where food is homogenised and served fast, fast fashion is the business model of replicating recent catwalk trends and high-fashion designs, mass-producing them at a low cost, and bringing them to retail quickly while demand is at its highest.

While eating a hamburger from MCD 0.00%↑ is timeless, a particular fashion or look has its peak and ebbs. We live in a somewhat vain world, like it or not, where first impressions and looks play a significant role. In fact, this phenomenon is presence in the Animalia and Plantae kingdom, where the strongest or most colourful male or female vies for the attention of the opposite counterpart.

Even flowers exhibit vibrant colours to attract insects for pollination.

So there is a science behind the need to look nice, and some companies are taking advantage of the natural laws of being attractive and wanting attention.

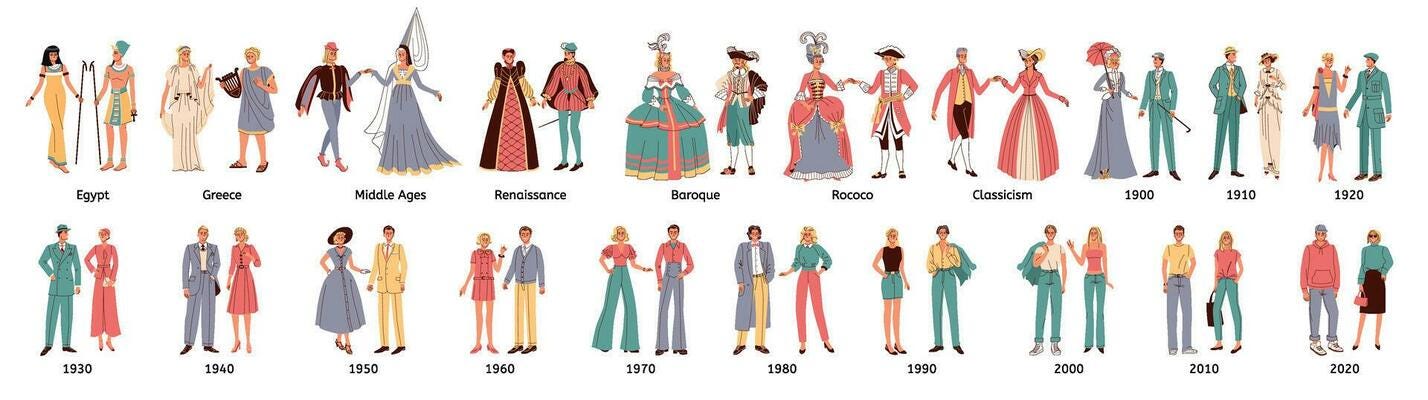

As the fashion industry is dynamic, it has seen plenty of evolution and iteration throughout history and the civilisation of mankind. Dressing as an ancient Pharaoh or queen in the modern world will still cover your modesty, but no one in their sane mind would adopt the Ancient Egyptian wardrobe for their daily wear.

As you can see above, back then one particular fashion stays in fashion through age, but has rapidly switch to a change once every 10 years.

In today’s world, fashion can last as fast as even just a year or just a few months. Traditional apparel companies that have found it hard to replicate and evolve has seen them fall out of favour.

History of Inditex & Zara

In the early 1960s, Amancio Ortega started a small apparel business with his wife, Rosalía Mera. It wasn’t until 15 years later, the first Zara shop was opened, producing popular fashion at low prices. The company continued growing and expanding their store counts in the following years.

1980 to 2000 were the critical years that made Inditex into the company it is today.

In 1985, Inditex was created as a holding company for Zara and its manufacturing plants. The company expanded out of its home country Spain, and created the company Pull and Bear, a casual menswear company in 1991. It also purchased 65% of Massimo Dutti, an upscale brand, before completing the total purchase in 1995.

In 1998, the Bershka brand was launched, aiming at the urban hip fashion and in 1999, the company purchased Stradivarius, a youthful female fashion brand.

Today, these brands are crucial to complement Inditex’s portfolio, with Zara being the main brand. Zara Home was launched 2003, with Inditex leveraging on the Zara brand to pivot into home furnishings.

Oysho, the fashion chain specialising in sport and leisure, was founded in 2001.

The company’s excellent manoeuvre in the fast fashion world has saw it emerging as the largest fashion company by revenue in 2019, having a global presence of more than 7,000 stores around the world.

The Ortega family

Call me old fashioned but Amancio Ortega is the kind of Executive that fits in my criteria of being shrewd and yet low profile.

To put it into perspective, the exact opposite of Elon Musk of TSLA 0.00%↑.

I manage to stumble upon this informative story of how Ortega Amancio and Rosalía Mera built Zara, and then passing the baton to Pablo Isla and then to Amancio’s youngest daughter, Marta Ortega.

Although Marta has only taken over from Pablo Isla, an outsider who succeeded Amancio, the past 4-5 years, Inditex’s share prices have rose to historical high, from the selloff of €17 per share after she was made chairperson to €50 per share today.

She remains as elusive as her father, preferring to shun the media limelight and has worked 15 years with the company, starting off at the ground level stacking clothes in Bershka while she was 23 years old.

While this does not guarantee immunity of getting displaced, at least the Ortega family has proven that they are still able to redefine what fast fashion is, striking a balance between maintaining quality and speed of product delivery to the market while competing against the likes of SHEIN.

While there isn’t much to be gathered from the news about Marta, those who have worked with her, and even fund managers, have nothing but good words about the heiress.

The heiress helm might have altered Zara’s direction, shunning fast fashion, going on a more sustainable route where it still brings the best fashion and quality at reasonable prices.

“We don’t want to be fast; we want to be agile and flexible.”

Marta Ortega, 2022

Why not SHEIN, H&M, Nike, Adidas or even Fast Retailing?

The fashion industry is fragmented and congested. To be even having thoughts of initiating or adding on to a position warrants scrutiny and reasonings.

I always like to use operating margin as an initial screen, comparing various companies from the same business to justify superior and durable margin.

Since SHEIN is not listed (yet!), I tabulated the listed competition and compared their operating margin.

I chose H & M Hennes & Mauritz AB (STO: HM-B), adidas AG (ETR: ADS), Nike Inc.NKE 0.00%↑, Fast Retailing Co Ltd (TSE: 9983) as close competition to Inditex.

I also included Prada SpA (HKG: 1913) even though it is a luxury brand just for context of the luxury segment margin. Those who might ask why not LVMH Moet Hennessy Louis Vuitton SE (EPA: MC), it is due to the more diversified and high margin businesses it has.

ITX’s operating margin has been superior versus its peers (and by quite a mile!), save from 2022 onwards when Prada outperform it.

Free cash flow margin wise, ITX has always been the one with the higher FCM margin.

Now let’s compare ITX with SHEIN. As SHEIN is not listed, info of its profitability can only be obtained from news snippets. For FY2024, SHEIN reported had an annual sales growth of +19%, achieving US$ 38 billion. ITX came in with +10.37%, with EUR 37.8 billion.

In terms of size, both SHEIN and ITX are similar based on the revenue they are generating, albeit SHEIN is growing at a far faster pace than ITX.

However, when it comes to profitability, ITX is far more profitable than SHEIN. SHEIN. SHEIN only managed US$ 1 billion in FY2024, giving it only a net margin of 2.6%.

ITX’s net margin has always been above 10%, excluding the COVID affected period.

A portfolio of brands that covers almost all of the fashion subsegments with a global presence

One of the reasons I see a potential long runway of growth is ITX’s brands and its current global presence.

Although having a handful of brands, when looked closer, these brands compliment the ITX portfolio rather than cannibalising it.

1. Zara

Target Market: Broad appeal for men, women, and children.

Focus: Trendy, fast fashion with frequent updates to collections.

Unique Traits: Rapid design-to-store process (as fast as 15 days), offering affordable yet stylish clothing.

2. Pull&Bear

Target Market: Youthful audience.

Focus: Casual and urban-inspired clothing with a laid-back vibe.

Unique Traits: Emphasizes streetwear and international trends with comfortable designs.

3. Massimo Dutti

Target Market: Sophisticated, cosmopolitan men and women.

Focus: Timeless and elegant styles with high-quality materials.

Unique Traits: Higher price point than Zara, focusing on classic rather than trend-driven fashion.

4. Bershka

Target Market: Trend-conscious youth.

Focus: Affordable, fast fashion blending urban and modern styles.

Unique Traits: Second-largest Inditex brand by store count, heavily trend-driven.

5. Stradivarius

Target Market: Young women.

Focus: Feminine and stylish designs with a chic aesthetic.

Unique Traits: Targets millennials with affordable yet trendy options.

6. Oysho

Target Market: Women.

Focus: Lingerie, loungewear, activewear, swimwear, and accessories.

Unique Traits: Combines comfort with style in intimate apparel and athletic wear.

7. Zara Home

Target Market: Home decor enthusiasts.

Focus: Affordable home textiles, furniture, and decorative items.

Unique Traits: Extends Zara's design ethos into interior design.

8. Lefties

Target Market: Budget-conscious shoppers.

Focus: Affordable fashion basics for men, women, and children.

Unique Traits: Operates in select markets as an outlet-style brand.

Stradivarius and Massimo Dutti positioned as a more premium brand is evident with its higher PBT/sales, but is still affordable to the larger target audience market, which are young female fashion conscious adults which are willing to spend on clothing.

Even if they are filling tight, they can always fall back to Zara or Bershka with no large detrimental differences in terms of quality.

In terms of presence, ITX is available globally, but the main bulk of its sales are still within Europe. Almost 51% of its sales are from Europe ex-Spain, with Spain, the home country contributing 15.1%.

Over in the Americas, despite the size of the addressable market, its only at 18.6%, and Asia & RoW is at 15.7%.

My thesis is that, there is plenty of growth for US and China. But definitely would need to drill down on the sales growth rate in a separate chapter.

Pt 1 concludes here, with the business model and basic landscape analysis covered!

If you can’t wait for Pt 2, please consider subscribing to get the latest updates once it is out!