Caterpillar Inc: Part 2 - The financials & competitor comparison

How does a Dividend Aristocrat's financials look like?

*For the business model of Caterpillar Inc, please head over here for Part 1.

CAT 0.00%↑ ‘s financials is impressive and resilient, which caught my eye and attention.

There are some fair shares of cyclicality, judging by the clients and sectors it services, but to be able to grow a moat in literally a pick & shovel business is not easy in reality.

Topline and operating metrics

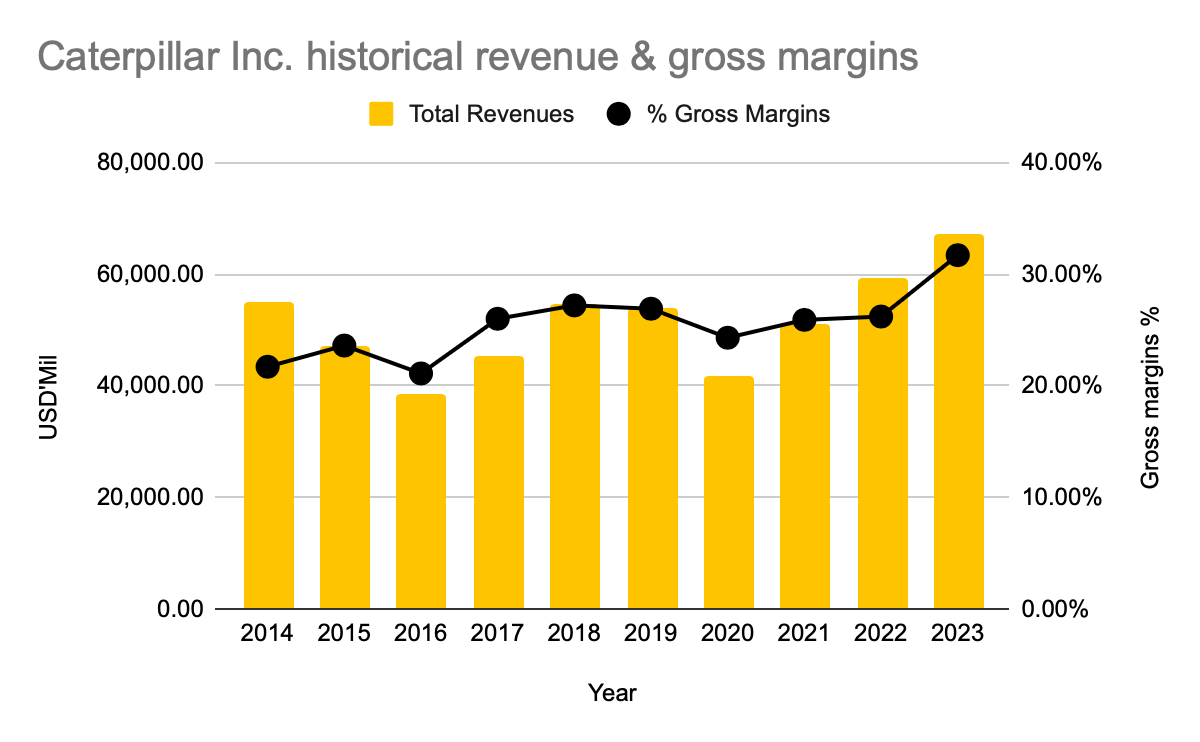

Although on a 10-year time horizon revenue is on an upward trend, there are cyclical bouts that the company experiences, visibly during FY 2016 & FY 2020.

For the uninitiated, FY 2016 was the year of the sub-mine crisis, where market cap of the Top 40 mining companies experienced their first ever collective net loss.

As for FY 2020, the pandemic also slowed down the construction sector, which put a dent in Cat’s top line.

The bright side of Cat’s cyclical clients, is its improving gross margins. For a heavy machinery manufacturer, it is remarkable that gross margins can still improve given its sheer size.

Balance sheet & key ratios

Cat’s balance sheet looks leveraged on the surface. For a company that has a hundred years of existence and has reached almost USD 200 billion, it isn’t much of a surprise for the company to fund its operation more via debt.

However behind the facade of a leveraged balance sheet, Cat surprisingly has good quick and current ratio. Running into a liquidity crunch shouldn’t be a grave concern due to the likelihood of occurrence.

With its prudent utilisation of debt, return on assets and return on equity has been on a long term uptrend.

Cash flow activities

The crux of Cat’s investment thesis, in my opinion, is its cash flow generation. Proudly proclaiming itself as a Dividend Aristocrat, it would be terrifying to know that it does not bring in the cash for it to sustain its dividend growth recurrence.

Cash flow from operating activities might look flat over the last 9 years, but surged past USD 10 billion in FY 2023.

Tagging along the surge is also the free cash flow and free cash flow margins.

The ability of Cat to continue growing its dividends is supported by fundamentals, and coupled with share buybacks, investors can anticipate better DPS and even share price appreciation.

Why Cat and not the others?

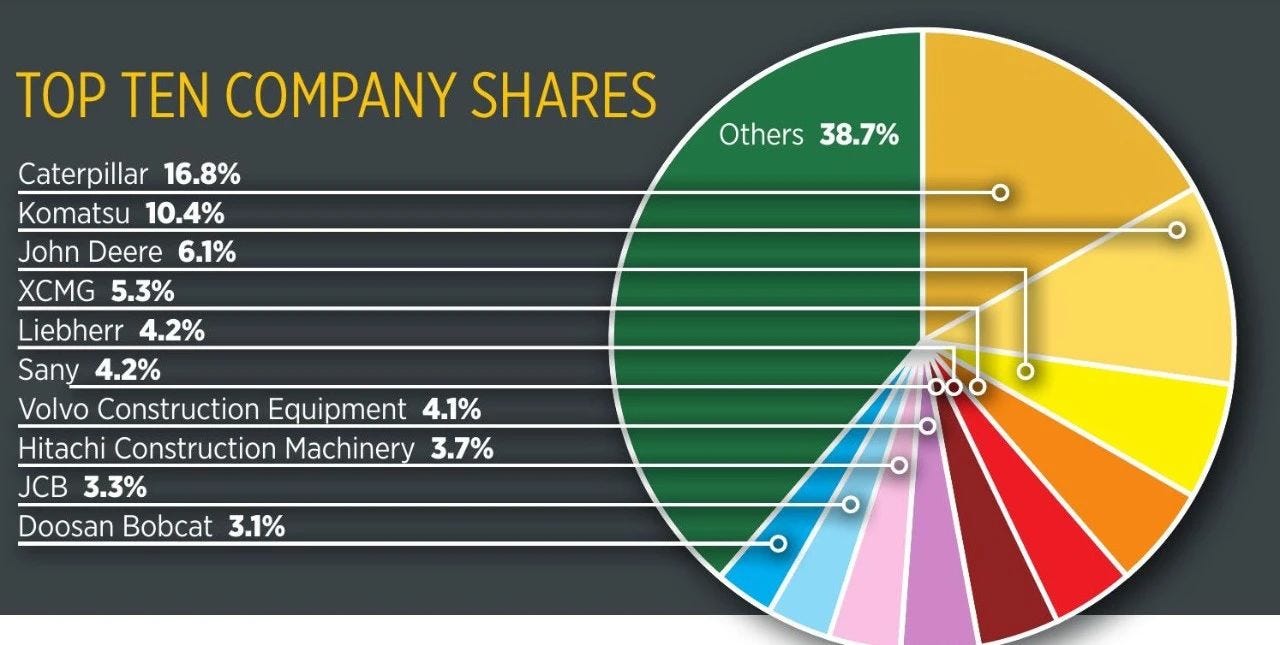

It is not easy to pick Cat out of the various players in the heavy equipment industry. And it is a fragmented and competitive space. Just purely in the West, Cat goes head to head with DE 0.00%↑ , Volvo AB, while in the East, there are easily more than 5 players, including the likes of Komatsu Ltd (TYO: 6301) from Japan, XCMG Construction Machinery Co Ltd (SHE: 000425), Sany Heavy Industry Co Ltd (HKG: 0631), Zoomlion Heavy Industry Science and Technology Co., Ltd. (HKG: 1157) from China.

Cat is the market leader in this space, but only commands less than 20% of the total global market share.

From a margin analysis across 10 years, it is evident that the US heavy equipment manufacturers command a better operating margin versus the players in Japan and China. Only the listed pure-play heavy equipment providers are compared against each other.

And the fundamental supremacy has translated to better shareholder returns as well. Both Cat and Deere have achieved 2-bagger returns over the last 5 years. The discrepancy widens if we pull back the timeframe to 10-years.

It’s a total package - growing margins and net profit tying in together with better shareholder returns. The smaller Chinese and Japanese players might be growing their revenue faster in some periods, but when it comes to trailing shareholder returns, Cat still bags it as the star amongst the congested and fragmented space.

The picks and shovels business can be cyclical - but is evergreen

Will humans ever not rely on materials, metals and ores?

Highly unlikely. We might have shrunk our computers into laptops and tablets over the last 100 years, but we still build skyscrapers, and even more buildings as data centres.

There is still an insatiable appetite for energy and infrastructure. The physical and tangible world will never be replaced by some metaverse. So long as there are requests for raw materials dug from the earth, or buildings to be built to house servers or even shelter us, I consider Cat’s business evergreen - albeit the cyclicality.

And being a proven Dividend Aristocrat just makes the stock even more convincing as a long term buy and hold - my favourite cup of tea!

But what would be a good price to pay for this wonderful business? Pt 3 Cat’s valuation & my strategy will dissect this.