Caterpillar Inc: Part 1 - The business

Who would have thought a company with the name of a bug can be a Dividend Aristocrat

To understand why I chose CAT 0.00%↑ as my next company to analyse, head over to my musings here.

Speak Caterpillar, and most will think of the larval stage of members of the order Lepidoptera (the insect order comprising butterflies and moths).

Stumbling on this company might become the de-facto image the next time the word “caterpillar” pops up.

Caterpillar’s history

The YouTube video below perfectly summarises the brief history, growth and evolution of the Caterpillar company.

Caterpillar’s Business Model

Caterpillar is a world leading manufacturer of construction and mining equipment. It also manufactures off-highway diesel and natural gas engines, industrial gas turbines (under the Solar Turbines brand) and also diesel-electric locomotives.

Throughout the years, Caterpillar not only grew its brand, but has also made accretive and synergistic acquisitions. Which is why it boasts quite a few well known brands under its portfolio.

Machinery breath wise, Caterpillar’s products ranges from the asphalt pavers and cold planers used for asphalt paving, to off road track dozers, mining shovels, excavators and the rugged off-highway trucks.

On top of selling new products and equipments through its vast dealer network, Caterpillar also does equipment rental and refurbishment of used equipment as well. They also have an extensive parts inventory to service existing clients who are looking to modify or repair tear and usage. Their Cat labelled logo are also found as merchandise that has its brand recognition within the mining and construction industry.

Revenue and geographical segmentation

I would consider Caterpillar having a fairly good mix of its revenue geographically.

Construction Industries (CI) revenue wise, North America has the lion's share oil 56%, following by EAME, Asia Pac and LATAM.

Resource Industries (RI) which services companies in the mining industries, North America sales is still larger albeit at 39%. with Asia Pac at 29%.

Similar observations as well for the Energy and Transportation (E&T) sector.

The dealer network

For a company that has presence all around the world, one of its key strengths is having a vast dealer network.

Caterpillar does not sells its machineries directly, it partners with dealers who might have exclusivity in certain areas or regions. Working with dealers mean that Caterpillar can fully focus on making the best products while letting its dealers handle the end user.

To find out more about the dealership model and why it is employed, I covered it as a note over here.

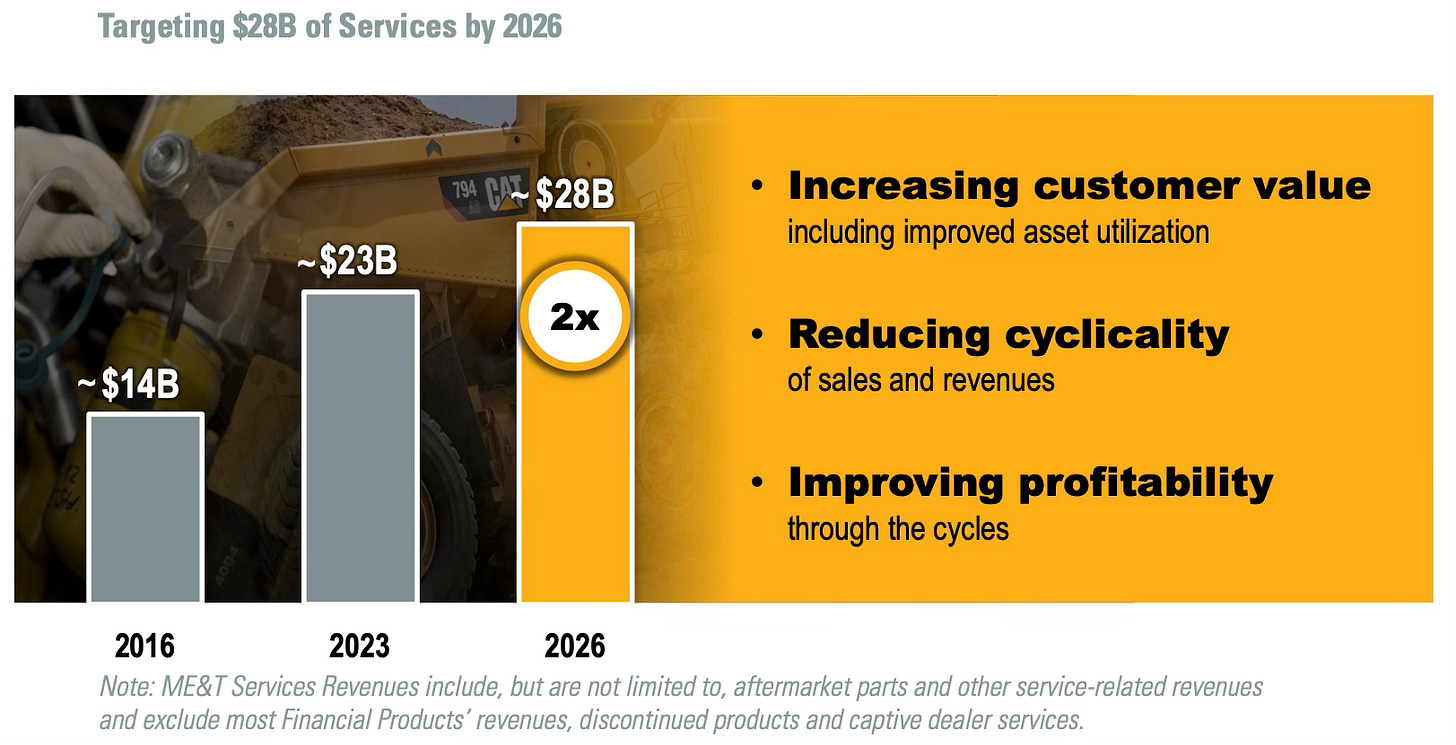

Tackling the cyclicality concern

Even the toughest tools will be weathered and worn out. And by acknowledging that, Caterpillar has also initiatives to grow its Services revenues. This portion of its business is repeatable, less cyclical, and provides a viable repetitive revenue for parts and other services.

With around US$ 23 billion coming from the Services vertical, over its FY 23 total revenue of US$ 69 billion, that is a healthy 36%.

My only gripe is that with an expected US$ 28 billion for Services expected for FY 2026, that is just a 6% CAGR growth for the 3 year period from 2023-2026.

Oh well, another side to look at it, is that quality products and tools don’t wear off that easily?

Why it warrants a deeper look and analysis

Those who know me, know that I am attracted to great businesses.

I may have 0 knowledge in a certain industry or a company, but if it looks like a great investment opportunity, I will embark on a deep dive to learn more, and quantify the prospects of the company.

But without going too deep into that, I think the track record needs to speak first for an evergreen businesses like Cat.

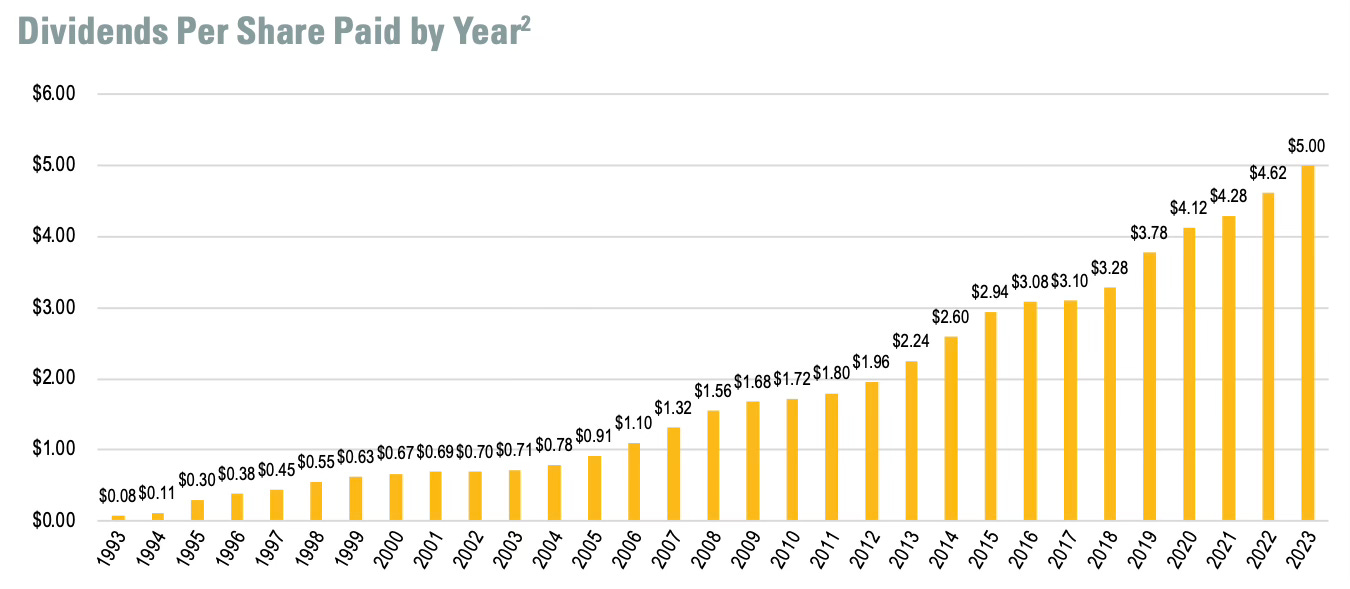

First off, dividends. This company is a Dividend Aristocrat, and has the track record of growing its dividend for the past 20+ years.

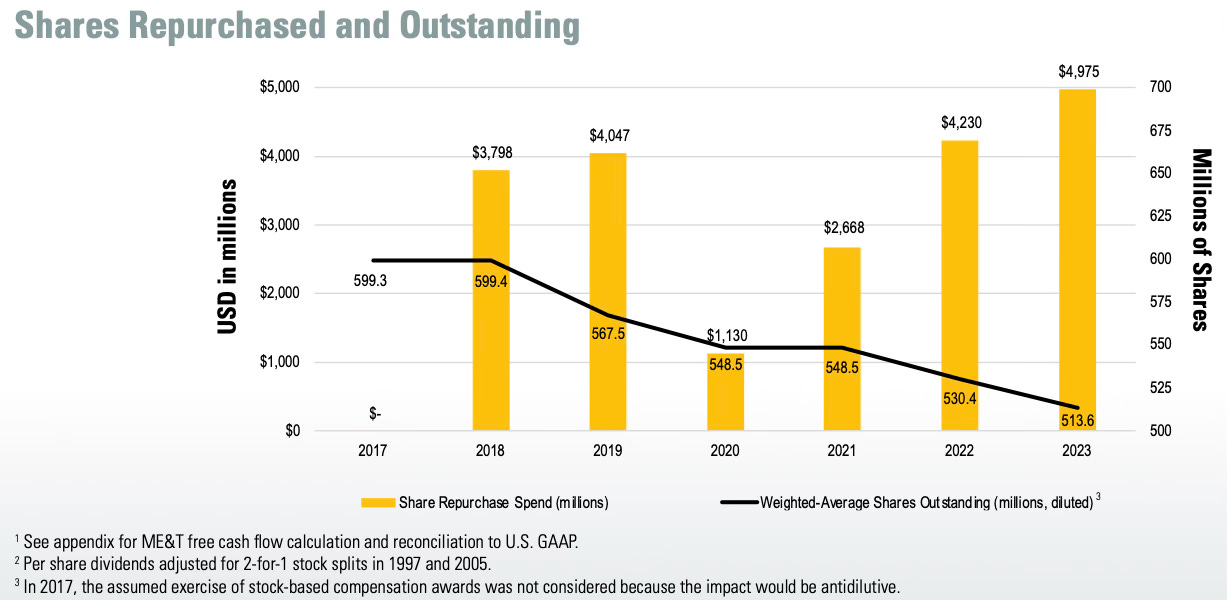

On top of that, Cat has also been doing frequent share buybacks too.

Weighted average shares outstanding has been trending lower, and so long if business continues to grow and improve, there is a predictability of Cat in growing its EPS, DPS and increasing its share buybacks.

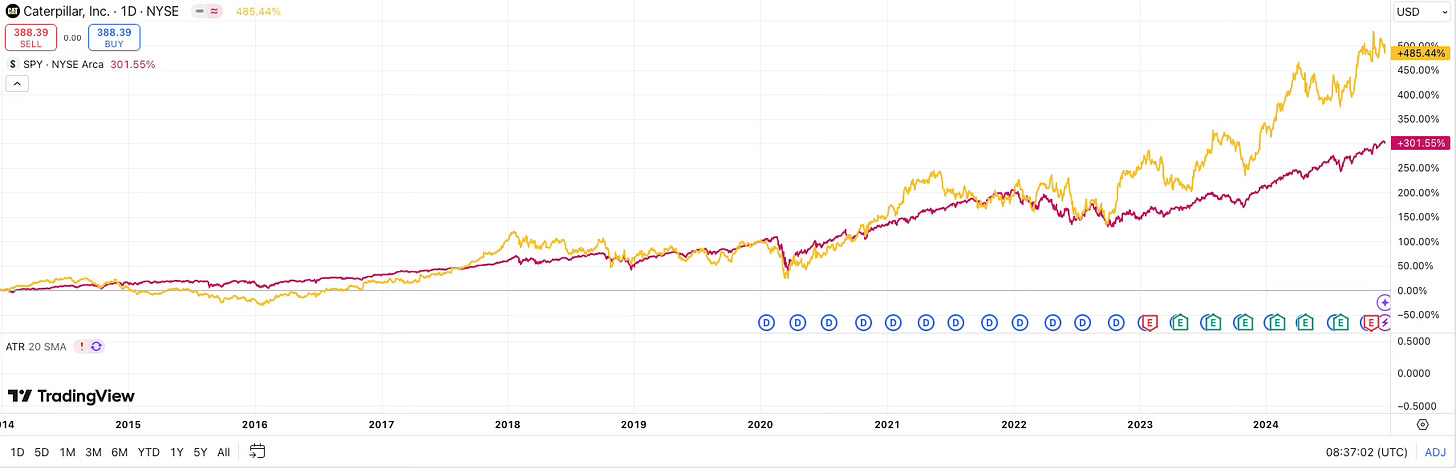

That all combined is just the perfect virtuous cycle for share prices to grow higher. This is already evident by looking at Cat’s 10-year performance against the SPY.

Definitely an eye-catcher, from business and track record perspective.

However, how will the financials deep dive look like?

Take a deeper look at Caterpillars financials here on my Substack once it’s ready!