Investments, in whatever type of assets, promise returns.

The real allure is when these returns become passive. Do nothing or something early and get rich later.

However, to kick off any investment journey, one needs capital deployed to assets of their choice.

It is imperative that you need money to grow money the passive route.

The normal daily job grind sees the majority of the world exchanging time for money. Only when there are savings idle in the bank account, then only the option of investing become unlocked.

Investing is sadly never for those who are fighting to survive. You need to have a steady income that is excess after your monthly expenses to qualify to invest.

Even if you do get started on your journey to investing, the initial few hundred thousand will not yield you significant returns to power you straight to financial independence.

It would take years, and maybe decades, of growing your portfolio to a significant size to generate returns that can sustain your monthly expenses.

Apart from getting a lucky windfall or even a lump sum inheritance, there really is no secret way to compound your portfolio. But the methods are straightforward.

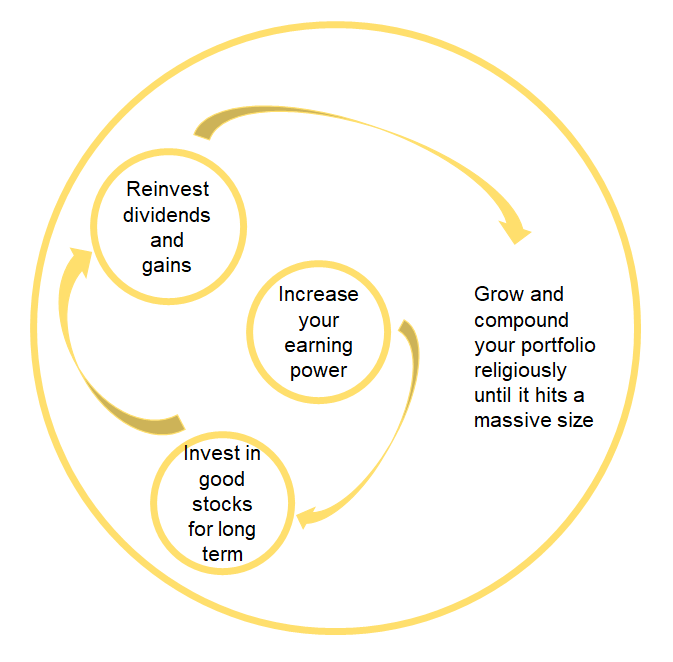

Taking a leaf out of Jeff Bezos, I call it the Investor Flywheel.

It all starts off with plowing in as much capital as you have. And to do that, you need to always increase your earning power. The more you earn, the more savings, and the more you can allocate to your war chest or dry powder.

All gains and dividends will compound and build up over time and should be reinvested as well. Only then the portfolio continue to compound at an accelerated and exponential rate, depending on each and our own means.

Each component of this flywheel is a separate topic on its own. And there will not be a right wrong creed and principle to do so.

It boils down to each and everyone’s own risk, willingness, and vision.

It will be a mundane and boring process to hit the first $100k. But things will get easier if all components of the flywheel are well practiced. The rationale for calling it a flywheel is that things will suddenly pick up and accelerate.

But trust me, the starting part is always the hardest.

Having enough money, and putting aside an amount to invest, is the hardest part.

The next hardest part will be to get literate in investment.

Then the next part is to trust the flywheel and be patient for the first 5-10 years.

Most people don’t make it past these 3 stages safely.

I am here just to remind you, that when these 3 stages pass, things will get easier.

Earn more, if you are still not earning enough.

Save more, if you are spending too much.

Learn more, if you are not investment literate.

And trust more, in the common sense of compounding.