I didn’t know TSLA 0.00%↑ will be reporting their deliveries number only just last year (Monday, 30 Dec 2024).

Rather than brand myself as a Tesla bear, I rather be called an opinionated fundamentalist.

I don’t follow the quarterly deliveries like a hawk.

Like every company in every sector that I cover in a deep dive, I play a game of simulation and scenario on whether the company is worth my time to dig deeper.

Tesla, even though I don’t really see any fundamental reasons for it to be bullish, I write and analyse about it time to time due to the attention the stock gets. And its good that I have an opinion about it to engage in healthy discussions.

A year has passed. Tesla has clearly underperformed the market up till November’24 where an out-of-the-blue-second-Trump-Presidential-term catalyst strapped the share prices onto a SpaceX rocket.

The share price can react to whatever and however it wants. I am here to talk about the fundamentals, and I mean the latest ones.

The hockey stick

Before we talk about a broken hockey stick, let’s talk about a proper one.

The hockey stick chart is a simple line graph where different data points are plotted and joined to form a line that looks like a hockey stick. Usually, this chart helps analyse the performance of companies, be it sales or profit growth, deliveries, bookings or/and even technical analysis.

An inflection point happens, when growth starts to explode suddenly, and continues growing as time goes by. This is evident in hyper growth companies growing their revenue or bookings. Or e-commerce companies reporting stronger GMV.

It is also the spurt where listed companies’ share price garner attention, usually popping by 10% to even 20% in some cases.

The pattern can continue to grow and rise exponentially, giving the hockey stick look that we are pretty familiar with.

Tesla’s latest deliveries, seemed to have broke its hockey stick.

The broken hockey stick

Elon can talks all he wants. Promises all he wants. Delays but delivers whatever he promises. But at the end of the day, the results and fundamentals do the final talking.

If fundamentals reflect what has been preached, share prices could appreciate further. If otherwise, share prices correct downwards.

The snap in Tesla’s deliveries have been prophesied by plenty of analysts and observers. They just didn’t expect that the latest actual deliveries were lower than their estimations.

The latest Jan’25 deliveries were important - it sought to prove a few things. Firstly, all the price cuts, throwing profitability out of the window for growth-at-all-expense, would help Tesla gain market share in a seemingly more congested and competitive space. And with software and other add-ons, this was supposed to be the iPhone’s walled garden blue print. But this wall pales in comparison with AAPL 0.00%↑’s.

It was also to prove yet another vital point - that Tesla Cybertrucks are not only headline grabbers but also a key revenue generator. That last bit did not really materialise, as under its “other models”, which comprises of aging Model S sedan, Model X SUV, and the Cybertruck, registered just 85,133 deliveries.

And with BYD now firmly holding onto the crown as the largest EV maker by deliveries, and with plenty of Chinese EV makers flooding the market, the Tesla name and halo has toned down significantly.

The Patels but in EV making

Picking a leaf out of Mohnish Prabrai’s The Dhandho Investor, Chinese EV makers are just like the Patels mentioned in the motels and hotels business, but in the EV making and sales realm.

You just can’t beat the Chinese in value and offerings.

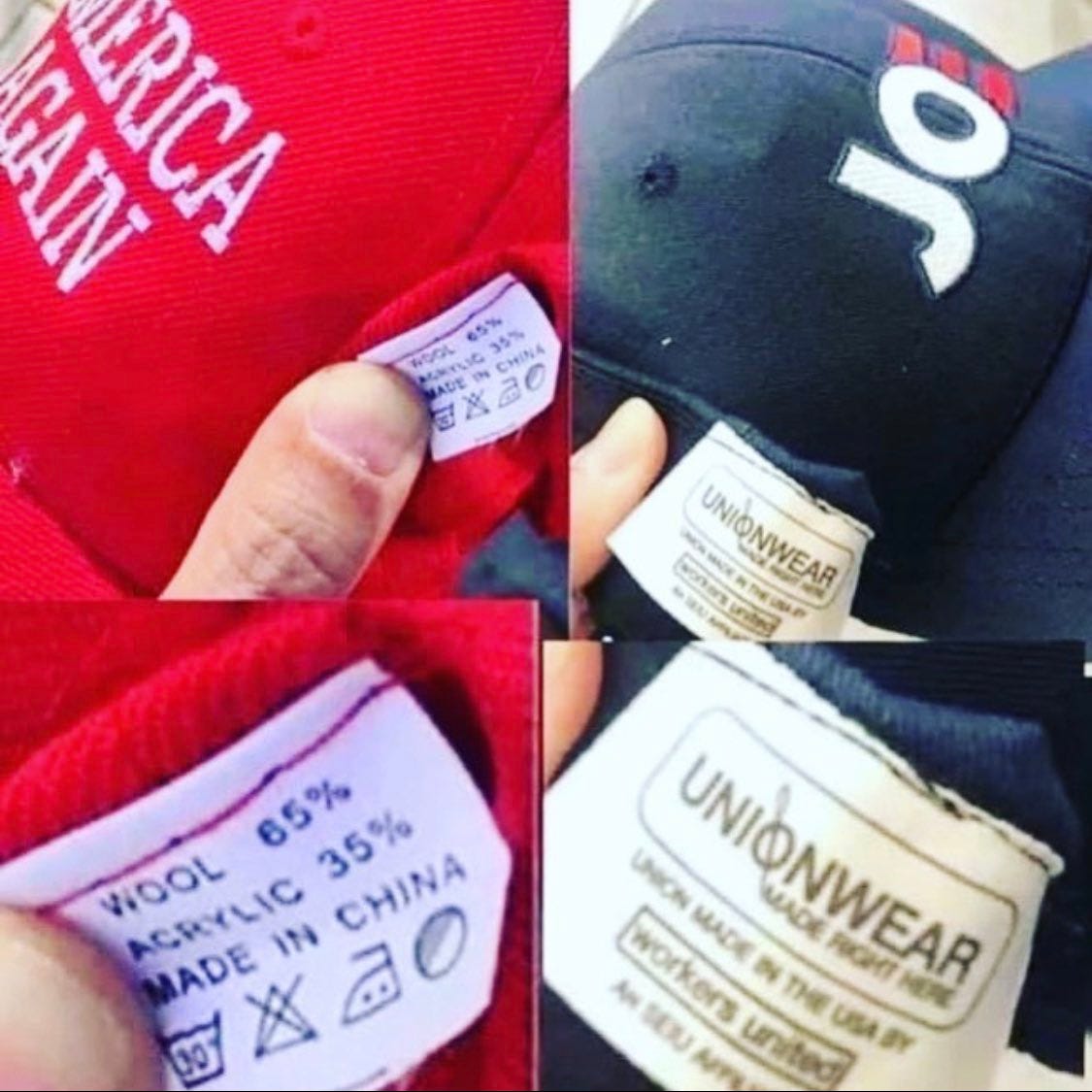

Even MAGA caps are made in China!

Fine if Tesla can’t beat the likes of BYD and NIO 0.00%↑, then fight them with autonomous driving, robotaxis.

No tangible dates on when Tesla is getting its green light for autonomous driving taxis while Waymo is already doing more than USD$ 300 million per quarter.

What’s next?

A year has passed, and I have not seen a glimpse of fundamental improvements or breakthrough when I first wrote about Tesla losing its Magnificent 7 shine.

TSLA losing the Magnificent 7 shine

It’s easy to still ride on the founder story like all growth investors swear on as a bullish thesis placebo.

Since then, we have gone through a lot of promises, that I think most of us can agree have not really been fundamentally helpful or even offer an insight of where and how Tesla is trying to grab back its crown. Even the planned cheaper model to fend off the Patels of the EV sector, are at most tangible by 2nd half of 2025? (if Elon keeps to his words miraculously!)

Even if Elon does deliver on time this time, the quality and value proposition, would be inferior to the Chinese makers.

So what is really the next catalyst for Tesla that can materialise in the next 2 years, giving it a form of advantage that its peers' will find it hard to crack?

I am cracking my head on this one as well.

I welcome your thoughts and inputs in the comments section!