Mapletree Industrial Trust 52-week low: Opportunity or Trap?

As MIT hits 52-week low, the million dollar question arises: Good buy or bloody trap?

Mapletree Industrial Trust (SGX: ME8U) is trading at its 52-week low of S$ 2.10 per share.

If you have been invested in the REIT for the last 5 years, you would be scratching your head as MIT did indeed rope in a 40% appreciation in unit price. As of now, you would be looking at a minor unrealized loss.

Whether it's an opportunity or a trap, let's take a look at its latest FY 23/24 results.

Plus point 1: Data Centres take centre stage in terms of contribution and emphasis

As of the latest FY, MIT owns 140 properties. Out of these 140 properties, 56 are data centres. Ratio-wise, that is 40%, but DCs contribute close to 55% of MIT's total AUM.

Even from the top 10 tenants by gross rental income, all of them are tenants of MIT's data centres.

Even the latest list of acquisitions and AEI, most if not all are related to DCs

The divestment of the Tanglin Halt Cluster will further concentrate MIT's DC reliance. If this continues, I won't be surprised that MIT will eventually change its name to Mapletree Data Centre Trust.

Plus point 2: Tenant Diversification sectors are resilient

The tenant diversification is not only diverse but also gives a glimpse of the resilience of the sectors. In the event of an unwanted downturn, most of the clients from the sectors would still continue their leases even when they approach expiry.

The InfoComm, a major of the manufacturing, financial, and business services, makes up at least 50% of the resilient sector that wouldn't see drastic shifts.

It also represents the REIT management's foresight when they decided to pivot MIT from a pure-play industrial REIT into a DC REIT.

It would be far-fetched to say MIT will eventually turn into a pure-play data centre REIT like Keppel DC REIT (SGX: AJBU). But the transformation for the last 10 years has been phenomenal.

Plus point 3: Interest rate risk looks to be in check

Ballooning Interest rate expense seems to be the Achilles heel for REITs globally. But looking at MIT's interest rate and risk management, I think management has performed well against its peers.

A large portion of its debt is fixed. And with interest rates now peaked, the weighted average all-in funding of 3.1% which stayed flat YoY is something commendable. ICR is brilliant at 4.5x.

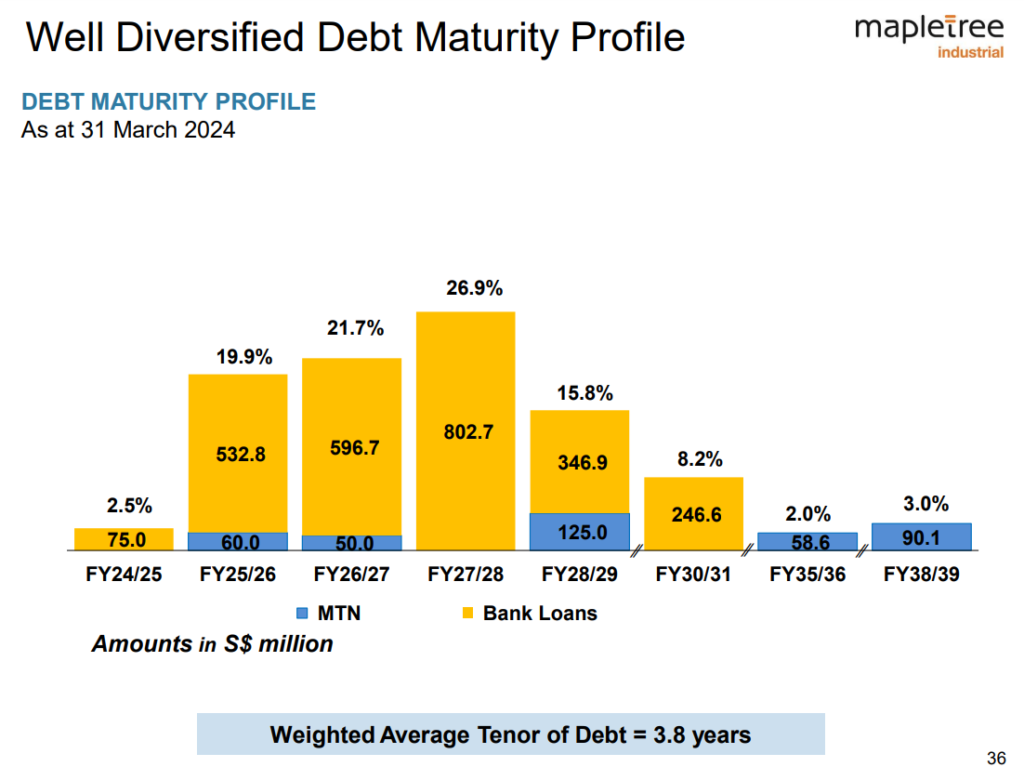

The debt maturity profile also looks set to take advantage when rate cuts occur, either end of 2024 or early 2025.

With the majority of its debt denominated in USD and SGD, it does not face an inherent interest rate risk from the JPY monetary policy.

Negative Point 1: Easing of data centre occupancy rates and light industrial buildings drag

Data centres, which have been the growth story and catalyst for MIT, show that this sector is not infallible.

AT&T, one of its tenants decided to not renew its lease, causing an ease in occupancy. All is not lost, as management has successfully secured a new lease with a healthcare services tenant for 30 years.

The light industrial buildings continue to be a drag. However, with a total AUM contribution of just 1%, it does not move the needle much.

Cautionary Point 1: When will demand for DC taper or cool off?

Although according to CBRE, even with the supply of DC growing at 26% YoY, with vacancy rates decreasing seems promising, there could be an inflection point where demand tapers off.

When will that happen? And would that send DC REITs down lower? It’s still unsure as of now.

Cautionary Point 2: A Trump win could pull MIT prices lower

My only concern that could derail MIT's recovery, would be a second Donald Trump term.

Yes, the rate cuts expectation that everyone thought would play out by Q2'24 since last year is not happening. As we enter Q3'24 even with concerns about even having 1 rate cut by this year, with the ongoing presidential debate, Trump's odds of winning do not bode well for REITs.

The US Treasury yields are pricing for a potential mix of stronger economic growth, higher inflation, and more Treasury supply in the event Trump wins.

MIT's debt maturity profile will present itself as a liability. Debt renewals will increase the average financing rate and whipsaw the DPU if all else remains the same.

MyKayaPlus Verdict

If the risk and context of the US Presidential election are removed, MIT looks to be a great opportunity at current levels. Yes, it still trades at a price-to-book ratio of 1.2x, but a trailing distribution yield of 6.4% at a peaked interest rate environment makes MIT a bargain.

Sadly like all REITs, interest rates and monetary policy, especially the USD can be affected by external factors that are out of MITs control.

I remain neutral with a tinge of negativity as a Trump win could spell trouble for REITs for the short and mid-term timeframe.

What do you think?

This is just one of the many free examples of how I analyze stocks and REITs for investment opportunities and build my case. On top of that, I utilize a foolproof blueprint to screen out good dividend stocks and REITs. If you are interested in learning how I do it, I humbly invite you to join my club!