Is Sim Leisure the next hidden gem of the SGX?

Fun is a serious business. But can it be a serious investment?

It’s not common to see a theme park or leisure business made readily investable for the retail masses.

On the KLCI exchange, there is only one - Genting Malaysia Berhad (KLCI: GENM). And then there is Straco Corporation Ltd (SGX: S85). Both companies are big players in the entertainment, hotel, and theme park business. Genting, as the name implies, owns and runs Genting Highlands, while Straco owns and runs the Singapore Flyer, Shanghai Ocean Aquarium, and other major attractions in China.

In 2019, a company with end-to-end expertise in designing, building, and operating theme parks was listed on the Catalist of Singapore Exchange. The name of the company might not ring any bell, but the accolades and projects managed by the company are familiar.

The stock price of Sim Leisure Group Ltd URR 0.00%↑ has surged more than 220% as of the time of writing. So are there more legs to the rally? Can this David go against the Goliaths in the industries?

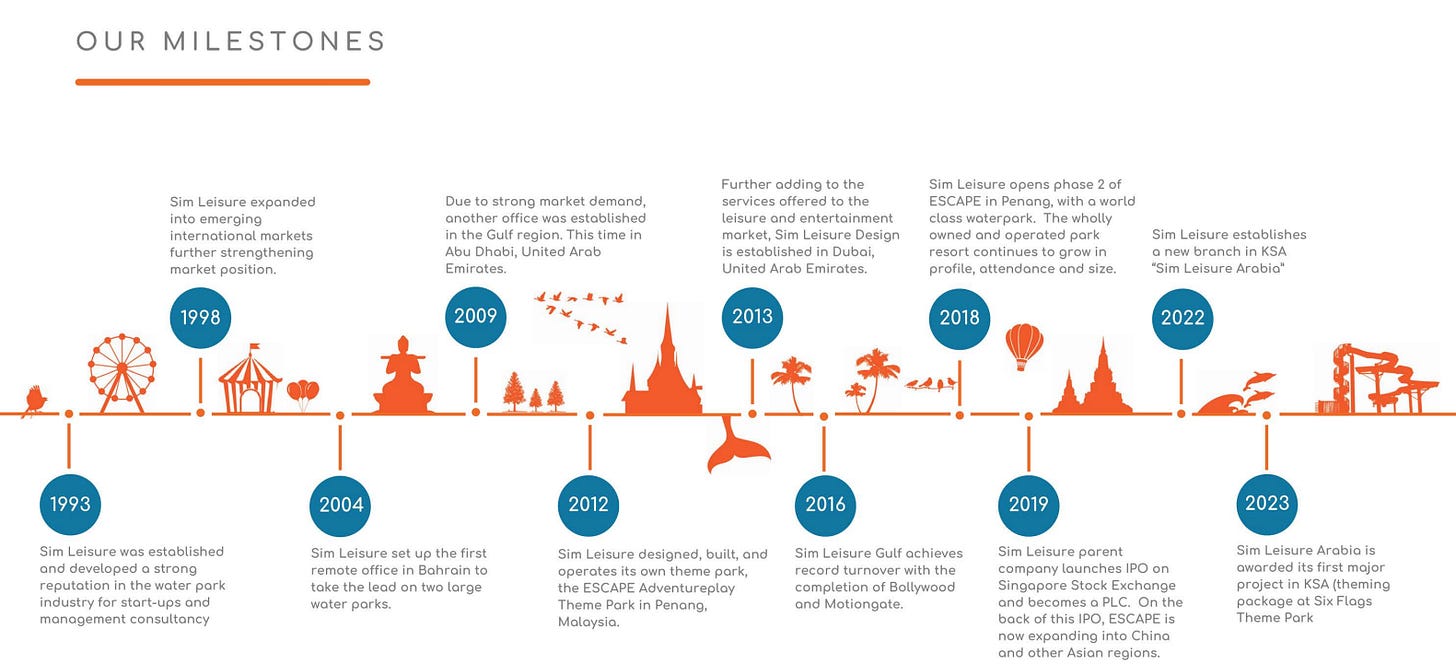

The Growth of Sim Leisure

Sim Leisure is the brainchild of Dato Sim Choo Kheng, a Penangnite who has more than 30 years in the Leisure industry.

Previously a Manager at the famed Penang Butterfly Park, Dato Sim eventually set up his own company, which then took on multiple projects from water and theme parks around the world. His first project from an interview I chanced upon, was none other than the Bukit Merah Water Park, just a quick drive from my home town Taiping.

Dato Sim came from a poor family. His younger days were spent in small kampungs (villages) where his mother ran and managed a chicken farm to feed the family. Although Dato Sim looks more polished right now, there is no hiding the boy inside him who yearns to bring his dreams of creating fun rides to reality.

Projects upon projects have sharpened Dato Sim’s expertise in managing greenfield projects, commissioning and operating water parks until Sim Leisure eventually started its theme park - The Escape Themepark in Telok Blangah, Penang, under the Penang Tourism initiatives.

Value proposal of Sim Leisure

The value proposal of Sim Leisure brought me surprise and some skepticism when I read about it.

Get this: the current theme park business model can be out of reach of the majority - given that some parks can cost US$120 [RM570] to US$150 per ticket. Licensing and trademarks, add to a capex-intensive business model.

Sim Leisure targets to grow its brand - Escape within Malaysia and also outside of Malaysia, in particular Sri Lanka, Oman, Qatar, Saudi Arabia, and China. While most of the glamorous theme parks are situated in the States and Europe, Sim Leisure has its eyes cast on the Middle East and Asia.

The Escape brand parks are the manifestations and testaments of Sim Leisure’s prowess - its first expertise is to start up and manage waterparks before eventually venturing into design, build services, fabrication, development, and even services, which encompasses safety management and online ticketing system.

Practically an “A to Z” park designer, owner and operator.

And it’s no wonder they boast a huge clientele globally.

Source: simleisure.com

Tip: head over to their 2023 Portfolio deck to understand in detail more about their technicalities and past achievements.

Management & Substantial shareholders

As of the FY 2022 Annual Report, Dato Sim owns 55.29% of the company shares, the largest shareholder with ample skin and flesh in the game.

His wife, Datin Silviya Georgieva, is also an Executive Director of the company as well.

Dato Sim has 3 sons, 2 of them working in Escape, marketing, and park operations.

Another substantial shareholder to be aware of is Tan Boon Seng, a serial entrepreneur and investor. Mr Tan is the eldest son of the late Datuk Vincent Tan of the Dragon-i Group of restaurants. He also owns the Hominsan, Ren, and Yayoi restaurant brands.

The remuneration band of the directors is as follows. Do note that for FY 2022, Sim Leisure reported a revenue of MYR 67.6 million. The remuneration band in SGD, might not offer too much insight on whether Dato Sim and his wife are over or reasonably remunerated.

Is a package of MYR 3.3 million a lot for a company that raked in MYR 67.6 million in revenue? Kinda. But if it’s a theme park visionary with a successful track record?

Maybe worth it?

Perhaps a breakdown in Ringgit on pg148 is more reassuring? MYR 3.35 million as of FY 2022 (7.5% of total revenue).

Dato Sim’s sons do not sit on the directorship circle. The individuals of the top 20 shareholdings of the company - Sim Goay Heoh and Sim Goay Hoon are the siblings of Dato Sim.

Dato Sim is very vocal about his stance against corruption which has been featured in the media multiple times. There is also a site and pledge on the company website that emphasizes this.

Revenue & operating profit trend

Now in the back of my head, I always imagined that theme park businesses are capex and opex intensive. The Walt Disney Company’s DIS 0.00%↑ theme park operating margins before the pandemic were consistently between 20-28%, factoring the premium admission tickets and curated experiences.

It is surprising to see Sim Leisure managing 21-46% before the pandemic, and even achieving a whopping 49.18% for FY 2022.

The financials do echo Dato Sim’s approach in running his Escape brand parks - go asset light.

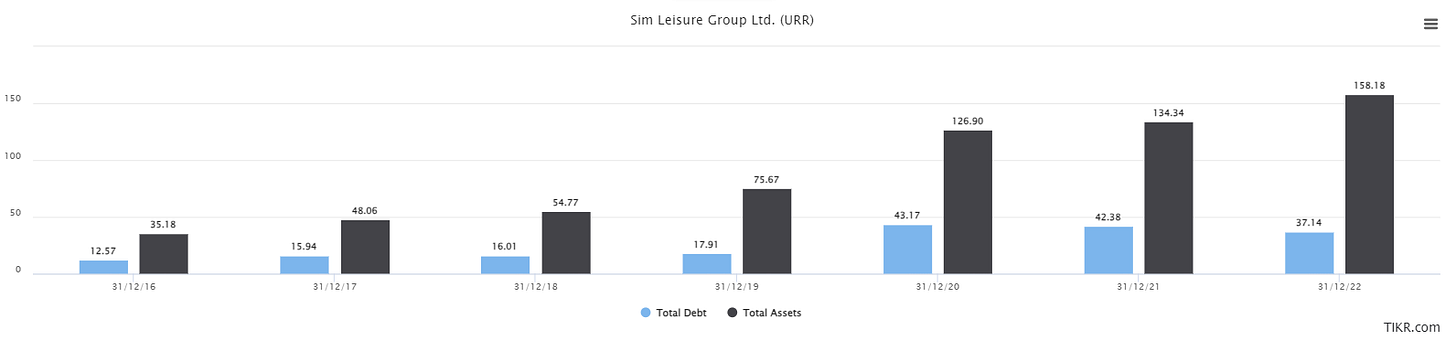

Debt levels are surprisingly well maintained when compared to its total assets growth. Digging deeper, total common equity grew at a faster rate, due to additional capital raising exercise and also a bit of help from growth in retained earnings.

The cashflow activities for the past few years jived back with what the management was planning - to grow in all areas. However, due to limited cash flow from operations, capital required for expansion came from a mixture of debt and private placements, with more portion coming from private placements, reconciling back to the growing total common equity on the balance sheet.

With a majority of its parks and experiences recovering post-pandemic, we see a huge spike in the operating cash flow for FY 2022, and also a bigger debt repayment amount as well.

From a free cash flow margin perspective, during the earlier days when Sim Leisure was still expanding, its FCF margin was erratic, compared to other well-known players like Disney, GENM, and Straco. But it showed the greatest recovery post-pandemic, achieving a higher FCF margin than its Goliath peers.

If their thesis and value proposition do play out well, we should see a continuation of this trend if there are no major capex cycles.

Concerns to take note of from the financial statements perspective

The company’s prudent debt utilization and management are highly appreciated as debt can make or break a business.

However, since it’s still a growing company, capex for growth is necessary, and can only come from shareholders’ pockets if it’s not from debt.

Sim Leisure has undertaken a few rounds of private placements. As the amount of capital raised is not staggering, it is done via private placements instead of rights or preferential offerings.

But that also means that retail investors would face dilution if the rate of dilution accelerates higher than the growth of the top and bottom lines of the company.

As Sim Leisure is still considered a small-cap stock with just a market cap of SGD 87 million, there could be potentially more private placements in the future to fuel the growth.

Concerns about the business model

A theme park is called a theme park due to brand recognition and an established fan base.

Regardless of how preposterous the ticket price or express pass costs, there will always be snaking queues and crowds. Try going to Disney Land and Universal Studios to envisage and experience it yourself.

People would and will pay for annual passes to maximize their experiences in such theme parks. This also reinforces my belief that an entertainment and leisure company like Disney is as perfect as it seems from a business model point of view.

How often would anyone revisit an Escape Park, which I think has the fun element, but without that brand or characters that evoke certain nostalgic memories or tug at your heartstrings?

You might argue that not everyone grew up with Disney’s Princes and Princesses, Mario, or Pokemon, but these cartoons and characters evoke that fairytale aura and experience that people are willing to pay for experience.

Plus, there are not many successful local standalone theme parks that have proven this business model can rival those of Universal Studios and Disney Land. Sunway Lagoon, Bukit Merah Laketown Waterpark, Movie Animation Park Studio, A Famosa Resort come to mind when trying to prove that this time it’s different for Sim Leisure

Sim Leisure’s future runway of growth

It is commendable that the management is also trying to bring fun to the urban areas.

It is running Kidzania Kuala Lumpur and took the risk of buying over failed Kidzania Singapore during the pandemic for just S$110,000 or MYR 379,398. Refurbishment expenses come to a total of S$ 3 million and Kidzania Singapore is slated to come online in Q1 2024.

The proof of concept of Escape Petaling Jaya, where it is possible to bring park and adventure experiences to the urban area within a mall will also give assurances and merits to other malls to consider having such attractions.

The company is also upping its VR game to appeal to those who might not enjoy outdoor and physical activities, under the Haven XR brand.

Kidzania Singapore should do well, as the company has a track record of running the Kuala Lumpur one.

With potentially more malls adopting an ESCAPE park or a Haven XR in their premises, we could be seeing more upside for Sim Leisure.

My verdict

Is there room and potential for parks like ESCAPE? Yes

Has the past few years of track record proven so? Yes

Does it predict the future? Not really

Does the company have a proven ability to grow amongst tough competition? Yes and internationally as well

Sim Leisure’s business model might not be the conventional theme park that is a guaranteed win and crowd pleaser, but there is no doubt that the company understands how fun can be without fancy characters and cartoons.

There are ample room and areas for the company to grow, unlike conventional theme parks.

With a return on assets of above 5%, saving for the periods affected by COVID-19 is admirable.

The shares might be a little illiquid, hence giving a very wide P/E range. It currently trades at a P/E of 13.46x as of writing.

I wouldn’t mind taking a small nibble at the right price and observing how Haven XR and Kidzania Singapore pens out for FY 2024.

What do you think?

Other articles for further reading:

optionstheedge.com

One issue about this company is that they do not have a moat and have no unique selling point. Their parks are easily replicateable. An aggressive and sufficiently motivated new entrant can give Sim Leisure a run for their money