How I Played Pokemon Is How I Invest

I found it fascinating that how I played Pokemon links back to how I invest

Boys will be boys, and a large part of my growing up was playing Pokemon.

It just dawned upon me that I find many similarities in playing Pokemon resonating with my investing style and preference.

Most might baulk or even wonder about the connotation.

So let me try and explain it.

The Pokemon gameplay

The gameplay of most mainstream Pokemon titles is straightforward. It usually involves the protagonist getting a starter Pokemon partner. He or she will then battle other trainers, catch new Pokemon, and try to build a team of 6 Pokemon on an active rooster.

The player will then build strong teams, and battle gyms across different in-game cities or towns while earning badges. Once a definite number of badges are collected, the player then challenges the Pokemon League to be proven and recognized as the best trainer - often called Pokemon Master.

Ever since the early generation 1 version running on Gameboy on cutesy 8-bit graphics, I had been an active player. However, as adulthood and reality strike, I find myself lagging.

I look at guides and the available before I pick my team

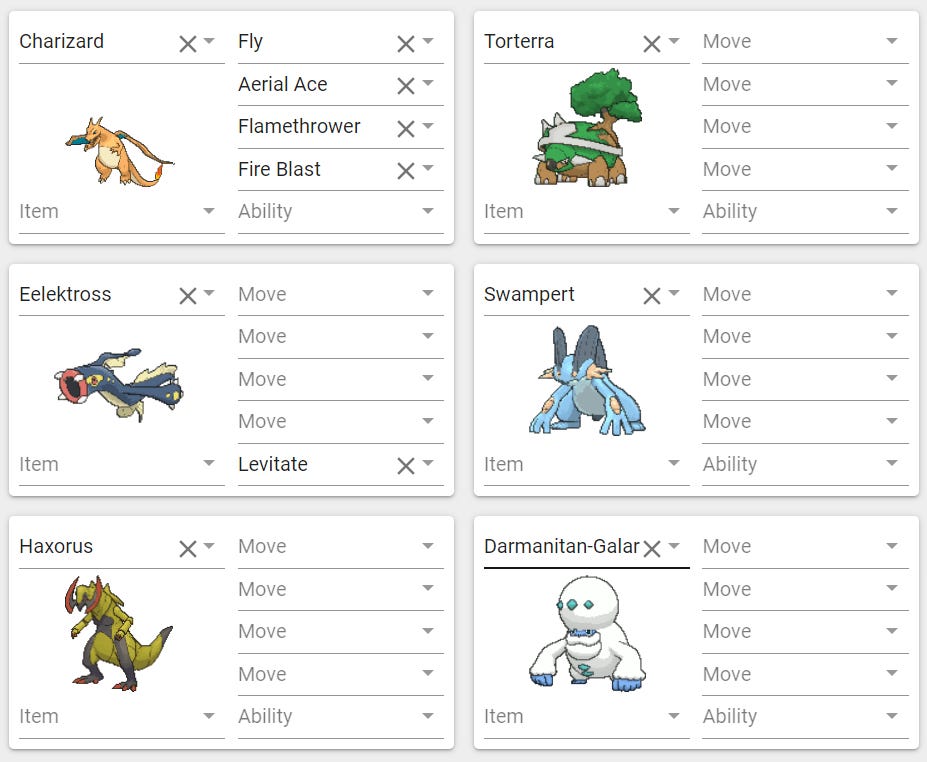

As guides and full Pokedex are made available, I have always had the knack of looking at what Pokemon are available while trying to craft a strong team.

Some Pokemon are region or version-exclusive. This means if you are not playing that particular version, you will not be able to catch it.

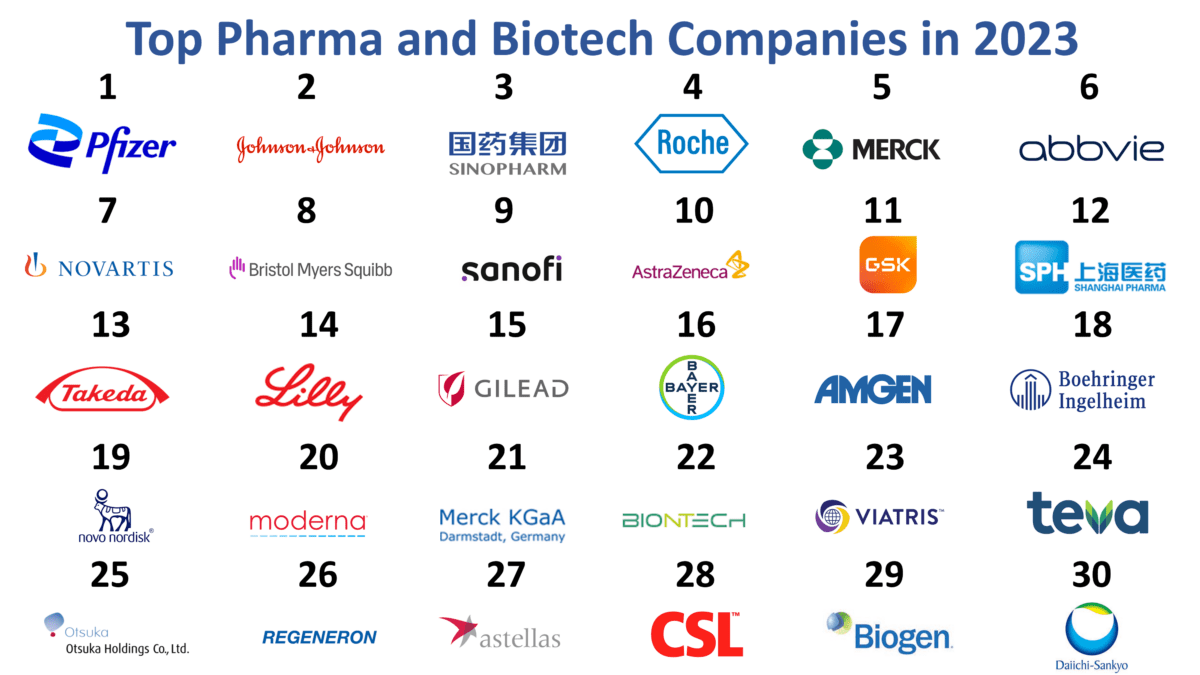

The same thought process applies to how I invest. If I am looking for a particular sector to invest in, I will scour the available list of companies before zooming down on a few to study.

While Pokemon guides can straight away tell you the best Pokemon for each type, this does not hold for investing. It usually takes days or even weeks to study and sieve out the best company from a sector to qualify as an investment candidate.

I am currently starting to research the pharmaceutical industry, and man it can be overwhelming. JNJ 0.00%↑ ABBV 0.00%↑ AMGN 0.00%↑ NVO 0.00%↑

I am team-diversified

Ever since primary school, I always felt it was dumb to build a team of 1 single-type Pokemon.

From the bug catchers in Viridian Forest to the type-specific gyms, I have found that relying just on 1 type where elements play such an important role in the game is a handicap move.

This is why I always try to pick a mix of Pokemon from different elements so that I won’t run into a situation where I am weak and powerless against a specific type.

Thus, I’m not an all-in tech or a pure REIT investor. I am a believer and practitioner of diversification.

In the world of Pokemon where you can only just build 6 a team, I am thankful there are no such limitations in the investing world when it comes to portfolio building.

And it is still fine to have a sector-concentrated portfolio, but just be aware that when there’s a sector correction, all stocks will be affected altogether.

I prefer dual-types

Somewhat along the newer generations, dual types are introduced.

Dual-types refers to Pokemon with 2 elements. An example would be Charizard, who is a fire + flying type.

From the investing perspective, it boils down to a combination of factors, like value growth, and dividend growth, to name a few.

A pure-play element will be purely deep value with no dividend or pure dividend but no growth play.

Growth became the de facto determinant for me in stocks to invest in. I don’t mind pure growth stock that holds on to retained earnings to reinvest back into the business. But again unlike the Pokemon universe where everything is pre-determined, in the world of investments, nothing is certain.

But I simply cannot tolerate companies with little to no growth.

Dual-type Pokemon (businesses) are usually fully evolved (matured) and are in their strongest form (economic moat and/or strong balance sheet). It will play a vital role in my portfolio for many years to come.

It’s not really about the end goal

Every game will eventually come to an end. So does life.

I’d be lying to say that I don’t want to see my portfolio NAV breaching 6, 7 and 8 figures. When it does, I consider it as the end goal based on current progress.

But that also means I will be at the tail end of my life.

I truly appreciate the journey now. I think it is one of the many small joys of life to study, monitor and form a thesis for a company. And which companies to buy at what price, even though it’s not a shopping time every day.

I remember the dopamine I got from Pokemon games back then, the max enjoyment was always from the start until the middle part of the game. It eventually tapers off when reaching the end game parts.

Some Pokemon from other regions are just, better

Some swear by the first generation - the Kanto region. Others include the Johto, Hoenn and Sinooh regions.

Each generation often means a different region with new Pokemon to catch.

In the investing world, I call that geographica diversification. I still remember the first Singapore stock I bought (CapitaLand India Trust) , the first US stock I bought META 0.00%↑ , and also the first HK stock I bought (Tencent Holdings Ltd).

Some companies are just one of a kind. And they win hands down when compared to the average Joe types of company.

If investing really is to be the very best investor version of yourself, I guess it is inherent and required to look at stocks all over the world for the best companies.

Maybe I am still playing games as an adult

Investing is not really a game. Even if it is, it is definitely not something everyone loves playing.

I struggle to come up with reasons on embracing this passion that started 8 years ago. It may have started out due to needs of securing retirement and eventually growing my wealth, but as mentioned earlier, I am in no hurry to force myself to hit any big numbers really soon.

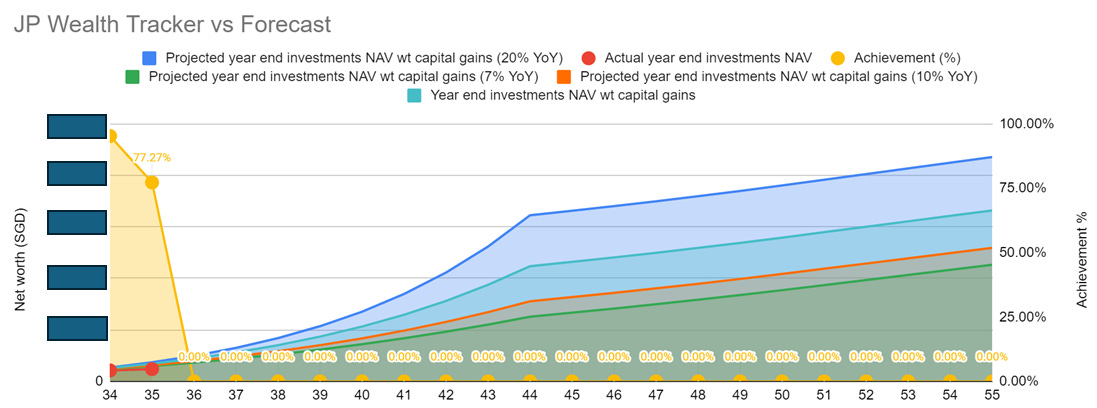

I do track my annual progress and drafted out a simulation of my potential end game NAV by age 55.

From now till age 45. I would still see myself earning more, reinvesting more, before coming to an age where increment dissipates.

At least having a yardstick reminds me of what I need to achieve on an annual basis, so that the end goal does materialize and does not end up as regrets.

Maybe I didn’t grow up. Maybe I just fell in love with other types of games :D

![OC] Starter Pokemon Final Evolutions: Baby Sprites!!! : r/pokemon OC] Starter Pokemon Final Evolutions: Baby Sprites!!! : r/pokemon](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F83e17592-33ee-4df1-9428-b12842372b29_525x189.png)